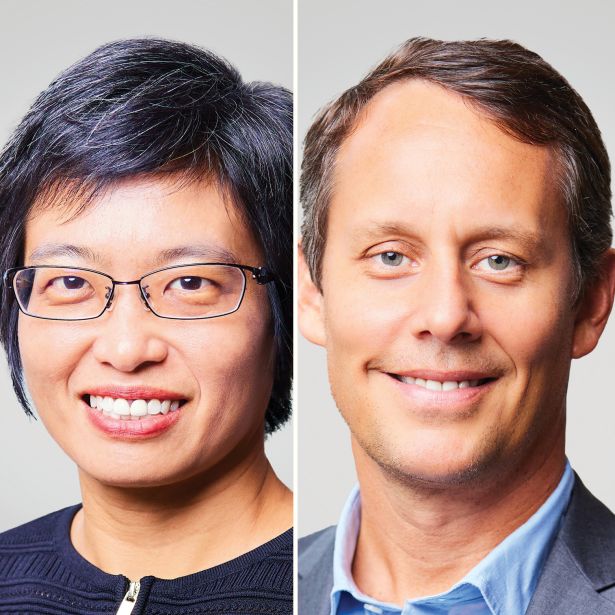

Chiang Ling Ng (left) and Alfonso Munk.

Chiang Ling Ng and Alfonso Munk

Co-heads of investment management at Hines

Between the two of them, Chiang Ling Ng and Alfonso Munk have more than half a century of financial experience, which helped them reshape the investment arm of 70-year-old owner and developer Hines into a global powerhouse.

The pair have been working in private equity and real estate for their entire careers, with Ng coming to Hines in 2021 as chief investment officer for Asia, and Munk joining in 2019 as chief investment officer for the Americas. At the start of this year, the pair began their duties as co-leads of the firm’s investment management unit, where they have led growth and performance.

“We were hired for a purpose: to establish and grow a permanent investment management business with a series of permanent sets of vehicles and funds that invest,” Munk said. “We came in and said, ‘Let’s create this suite of products, what we call the architecture of funds.’ ”

Thanks to Ng and Munk, Hines implemented three active funds that previously didn’t exist. Their goal was to turn Hines into a global force to be reckoned with through more standardized and homogeneous investment vehicles.

Munk was responsible for launching Hines U.S. Property Partners (HUSPP), the firm’s flagship core-plus open-end fund, which has a projected gross asset value target of more than $3 billion by the third quarter of 2025. Since the first quarter of 2025, HUSPP has deployed more than $600 million by gross asset value across the firm’s high-conviction sectors — housing, industrial and alternatives — with acquisitions that include the $221 million purchase of the Lenox and the Quinn, a pair of Class A multifamily buildings in Jersey City, N.J.

Last year Ng helped to grow Hines’ assets under management in the Asia division to $8.5 billion, while also securing the largest single transaction of an Australian retail center — the equivalent of about $585 million — in Sydney.

The duo acknowledged three key aspects of their roles: creating the product, raising capital, and performance — with the last aspect being most important to them both.

“We deliver performance to our investors,” Munk said. “We have a saying at Hines, which is ‘Performance is all that matters.’ Ultimately, the way you deliver to your clients is not just buying assets or making investments, because everybody can do that. It’s making investments that actually generate the performance that you promised to your clients.”