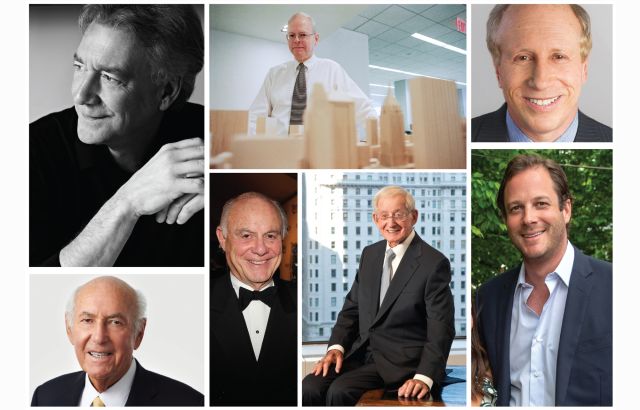

Len O'Donnell (left), Craig Solomon (top right) and Laurie Golub.

Len O’Donnell, Craig Solomon and Laurie Golub

Chairman and CEO; chief investment officer; chief operating officer at Affinius Capital

Last year's rank: 57

Over the last year, the senior leadership at Affinius Capital has been laser-focused on providing credit and equity for complex real estate transactions while simultaneously protecting itself and its clients from the worst threats of a high interest rate environment.

Whether it’s rebalancing loans, proactive asset management, or ensuring its equity investments aren’t dangerously levered, Affinius wore many hats in 2024, during which time it loaned credit to multifamily and industrial projects and injected equity into industrial and data center deals.

“Affinius’ success in 2024 stemmed from playing both offense and defense where appropriate,” said CEO Len O’Donnell. “Our vertically integrated and diversified platform allows us to be nimble in credit, patient in equity, and opportunistic in sectors where demand is structurally driven — not just cyclical.”

One area that Affinius aims to differentiate itself is in data centers. The firm launched a strategic push with its affiliate and operator Corscale Data Centers to deploy investment equity into the space, one that holds a $25 billion pipeline for future projects.

“On the equity side, we have seen huge opportunities in data centers,” said Laurie Golub. “The world is digitizing — in a world 10 years from now, probably everything is digital, and it will require data. It’s a growth area of our business more broadly.”

Other major deals that defined the year for Affinius included financing the preferred equity in a $355 million construction package for The Durst Organization for its 20-30 Halletts Point in Queens; originating a $184 million whole loan to Gencom to acquire the Thompson Central Park, a 587-key hotel in Manhattan; and originating a $174 million whole loan to Goldman Sachs and Lincoln Property Company to refinance a 2.4 million-square-foot industrial park in Glendale, Ariz.

O’Donnell emphasized that Affinius’ secret sauce lies in the design of its platform, where it operates across the capital stack and risk spectrum, giving itself room to “dial up” or “dial down” risk as market conditions shift and investors rapidly change their sentiments or convictions.

“It allows us to be early — not just reactive — when new cycles emerge and market trends are developing,” O’Donnell said.