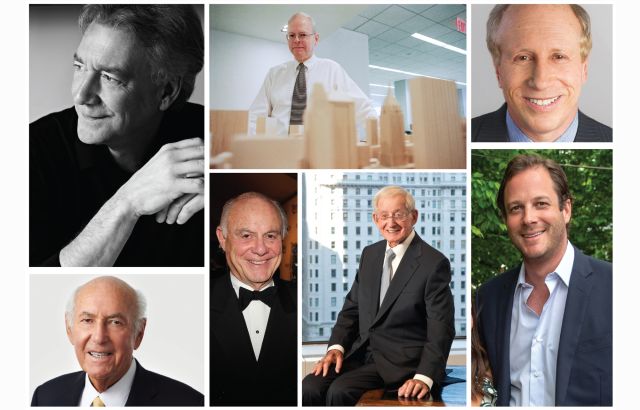

Anant Yardi (left) and John Santora (right).

Anant Yardi and John Santora

Founder and CEO and president at Yardi Systems; CEO at WeWork

2024 was a banner year for both Yardi Systems and for WeWork, not least because the companies’ growth trajectories are now deeply intertwined.

Yardi last April paid $337 million for a majority stake in the formerly troubled coworking space provider to help it exit bankruptcy, which it did in June. It was a bold move, given the fact that WeWork had never actually been profitable.

Yet Anant Yardi and his namesake company, which turned 40 last year and in January 2024 launched the latest version of its property management platform, are confident in the viability of flex office spaces in a post-pandemic world. As companies such as Amazon, Google and J.P. Morgan seek to accommodate employees who had spent years working remotely, the potential of flex is actually boosted rather than hindered, Anant Yardi told CO last year.

Enter John Santora. Not long after Yardi acquired WeWork, the 47-year veteran of Cushman & Wakefield actually called Anant Yardi on behalf of the brokerage to pitch its services. Anant ultimately offered Santora the CEO position instead.

Once he accepted, Santora hit the ground running. Last fall, his freshly revamped company partnered with Vast Coworking Group to allow WeWork members to use any of Vast’s 75 locations. In December, the company leased nearly 304,000 square feet in Midtown Manhattan on behalf of Amazon, which had already partnered with WeWork on two other locations as an enterprise member. WeWork, too, earlier this year acquired full ownership of its Brazilian portfolio, totaling 28 locations, from the SoftBank Latin America Fund. Currently, WeWork has more than 600 locations in 120 cities globally, spanning some 45 million square feet.

There’s little sign of slowing down this year, as WeWork plans to spend $80 million to $100 million updating its spaces worldwide, Santora said. The former C&W New York tri-state chairman is also keeping a particularly close eye on WeWork’s enterprise operations.

“I think there’s significant [potential for] growth in the enterprise portion of our business,” Santora said. “Corporates and large users of space have said — and it’s clear — that they need a flexible component of their real estate. They can’t continue or go down the path of having everything in long-term leases or owned, and not having the ability to pull back or expand quickly as markets change and adjust around the world.”