Colleen Wenke

President and chief operating officer at Taconic Partners

What’s your assessment of the New York City real estate market in 2025?

Overall, demand is back across a number of sectors. Meeting housing demand remains one of the top issues, and ensuring there are strong incentives for new development is paramount. A pathway to affordability is to create more supply.

The office market is trending back in the right direction after pandemic-related issues, and, for believers in New York, this isn’t surprising as the city remains the top destination to do business in the world.

Retail leasing also continues to remain strong. The world’s top brands want footprints here, and I only see that trend increasing as we build more housing and the office comeback gains momentum.

If you could change one law in New York City to benefit your business, what would it be?

I want developers to be able to bring more housing to market more quickly, so however that can be achieved would be my priority.

What is the future of life sciences in U.S. commercial real estate?

Some headwinds remain in this sector, obviously, but life sciences and health care remain growth markets in the long run. There will ultimately be demand in the cities like New York, where companies, hospitals, academic institutions, and biomedical and pharma innovators want to be.

How has Essex Crossing performed, with a decade of hindsight to judge the Manhattan project? How is Taconic planning to fill the space of tenants who have vacated?

Overall, Essex Crossing has been a success, especially from residential, retail and experiential perspectives. The sales and leasing results in the residential buildings speak for themselves. We also have many high-profile, stable retail tenants throughout the development, and we are progressing a pivot to the below-grade retail space.

The proof, though, is in how the overall destination has been embraced because we responded to the needs of the neighborhood, regardless of the challenges the pandemic brought.

Lighting Round:

Borrowing costs up or down by late 2026?

Down.

More excited about — interest rate cut or Taylor Swift’s engagement?

With all due respect to Taylor Swift, interest rate cuts.

Last vacation and where?

We rented an old stone house in Tuscany this past summer, which was a lovely escape, and I would highly recommend it.

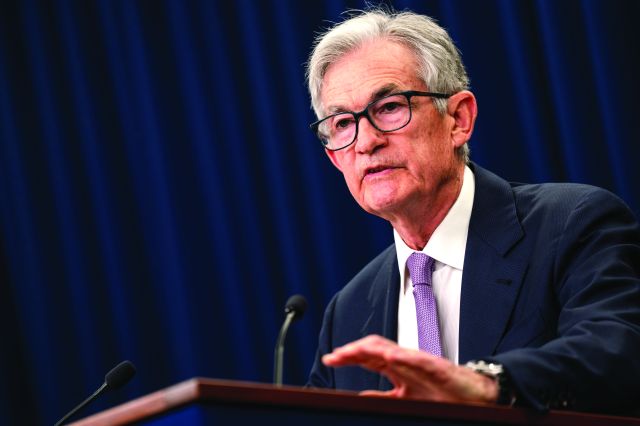

Like in ‘Freaky Friday’ you swap bodies with Jerome Powell. What would you do?

Continue to lower rates and incentivize more development and capital activity.

What’s your kryptonite?

I have trypophobia. Look it up. Gross.

How are the tariffs going to affect your Thanksgiving shopping?

I go for the classics, so no one should expect any changes at the table this year.

If Stephen Starr asked you which restaurant he should next reopen, what would it be?

Bring back Morimoto.