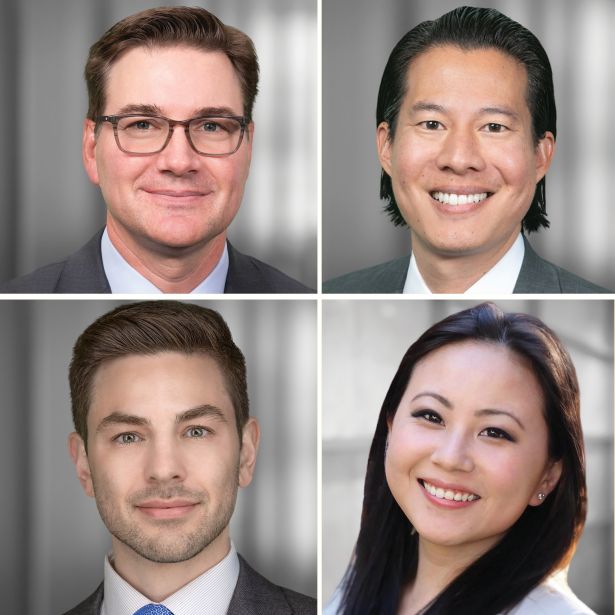

Clockwise from top left: Justin Guichard, Warren Min, Katy Mao, and Aaron Greenberg.

Justin Guichard, Warren Min, Aaron Greenberg and Katy Mao

Managing director and co-portfolio manager; managing director and assistant portfolio manager; managing director and assistant portfolio manager; managing director at Oaktree Capital

Last year's rank: 46

In a year of uncertainty due to higher interest rates and other factors, Oaktree clung to equilibrium — a value that’s spread from the company’s leaves down through its roots.

“One of our key tenets at Oaktree is ‘emphasis on consistency,’ which has been ingrained from the top down starting with co-chairmen Howard Marks and Bruce Karsh,” Justin Guichard told Commercial Observer via email.

Guichard, alongside Warren Min, Aaron Greenberg and Katy Mao, spearheaded the real estate team’s $1.4 billion in 2023 transactions. Certainty of execution attracts borrowers; Oaktree’s team delivers on their promises — and the market takes note.

Oaktree’s investment portfolio reflects the team’s strategy for adding value; it encompasses both private debt and traded securities throughout the capital structure.

“The synergy between our equity and debt teams ensures that, as lenders, we genuinely understand the priorities of our borrowers,” said Guichard. “This enables us to provide creative structures to address the diverse needs of the equity stakeholders.”

The company’s loan portfolio includes core asset types with strong fundamentals: multifamily, hospitality, industrial, residential and the like. Relative to years prior, there’s also been a focus on the middle market, thanks to regional banks’ lack of liquidity. Recently, Oaktree has even been active in Australia’s condo construction market, taking advantage of its attractive pricing and favorable creditor protections.

Granted, the last year has had its fair share of lessons that offer guidance for the future. The collapse in office valuations, for example, exceeded even Oaktree’s conservative assumptions.

“Many floating-rate capital structures put in place before the 500 basis point rise in SOFR weren’t built to sustain such a dramatic increase in financing costs,” Guichard said, referring to the secured overnight financing rate, a key benchmark for short-term borrowing. “Today, as commercial real estate values reset lower due to higher borrowing costs, the focus in our performing debt strategy is on first-lien opportunities.”