Will Blodgett

Founder and CEO at Tredway

Are you going to buy in `25? If so, what asset class?

We have been buying affordable housing assets in 2024, and will continue to buy in 2025. The statistics are staggering and getting worse every year: In no state, county or city can a full-time minimum-wage worker afford a modest two-bedroom rental. We are humbled to be in a position to bring this hand up, not a handout, to thousands across the country.

Is there a single “good” sign you see in a distressed property that makes you want to buy it?

A good asset in a strong market with a poorly structured capital stack. We sprint to opportunities where we can rightsize and rebuild existing affordable properties in ways that preserve and enhance them for future generations.

What real estate or tax policy would you like to see from a Trump administration?

The highest possible funding for affordable housing and homelessness assistance programs at the federal level, and the expansion and reform of the Low-Income Housing Tax Credit (LIHTC) to incentivize new construction starts and the rehab of existing properties. We also desperately need bipartisan policy to mitigate unprecedented increases in insurance costs, which are hitting affordable housing providers especially hard.

If you could stack the new administration with people you know and do business with, who would you choose?

Willy Walker (Walker & Dunlop),David Leopold (Berkadia Affordable), Kim Darga (NYC Departmnt of Housing Preservation and Development Department, Victor Sozio (Ariel Property Advisors), Ben Brown (Brookfield), Barry Gosin (Newmark), Ron Moelis (L+M), Mathew Wambua (Merchants Capital).

Which market (outside of NYC) do you like best?

We like quality markets that create economic upside for our residents. An affordable home is the first step on the ladder to socioeconomic mobility, and we choose to operate in high-opportunity markets that don’t require an individual to commute two hours each way to work because that’s not sustainable economically, socially or environmentally. By that measure, there is no better place for affordable housing than New York City. But there are others as well — Texas, the Carolinas, Tennessee, Nevada, Pennsylvania and New Jersey are all states we are active in.

What’s going to be your biggest expense in 2025?

Insurance, hands down, is making building, owning, and operating affordable housing prohibitive, and has both short- and long-term implications for our ability to address the availability and affordability of housing at all price points. We need more people building and preserving affordable housing — not less — but if insurance rates continue to rise and availability declines, then providers will either avoid or exit the affordable housing market altogether, causing direct harm to millions of Americans nationwide.

How’s the financing climate for new development and redevelopment — hot, cold or just right?

It’s improving but the recent spike in the 10-year [Treasury] did not help our industry. My concern is that bad actors have made, and will continue to make, lenders less flexible in how they partner with good actors. This could potentially constrain capital that would otherwise be deployed to build and preserve much-needed housing.

What are your predictions for the mayor’s City of Yes, especially given the controversies within the Adams administration?

Policy over politics. The fact is City of Yes for Housing Opportunity will eliminate key barriers to multifamily development of all types. It’s pragmatic and addresses the uneven patterns of housing development that have plagued the city for decades. Regardless of what else is going on, we should not lose sight of that. Homelessness is a housing issue. Create more homes, achieve less homelessness.

Lightning Round:

Your social media of choice?

LinkedIn.

AI: Helpful in CRE or a fad?

Helpful. Very.

Last movie you saw in a theater?

“Despicable Me 4.” My 9- and 7-year-olds loved it, but it may have scarred my 4-year-old for life.

You’re going on a six-month expedition into the Amazon rainforest. What’s your last meal before you get on the plane?

Amsterdam Ale House wings and nachos.

Tesla or BMW?

Whatever gets me from Point A to Point B. I’m not much of a car guy.

Will interest rates be below or above 4 percent on July 1, 2025?

Yes — they will either be below or above 4 percent.

If you could partner with one person in the business on a property, who would it be?

Ron Moelis.

What are you tired of talking about?

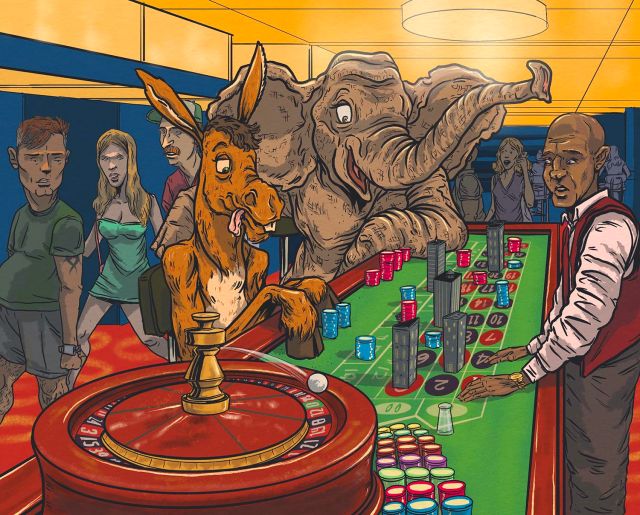

Rates and elections.