Tawan Davis

Founding partner and CEO at The Steinbridge Group

Are you going to buy in `25? If so, what asset class?

We’ll buy in 2025. We’ll focus on developing and redeveloping single-family and multifamily residences for the middle market.

Is there a single “good” sign you see in a distressed property that makes you want to buy it?

Increasing market values of nearby immediate comparables in comparison to that particular property.

What real estate or tax policy would you like to see from a Trump administration?

I think that the contribution of federal land and unused buildings is a long overdue idea that could address the fundamental undersupply of housing for Americans. This was a plank in both campaigns.

Let’s talk about multifamily. Do you ever see yourself building normal, middle-class rentals again? What would stop you?

Middle-class homes — absolutely! We have nearly 2,000 units in different stages of development or predevelopment today. Another spike in interest rates or materials prices driven by geopolitics or disasters would hamper that continued expansion.

Which market (outside of NYC) do you like best? Which market (including NYC) are you most fearful of?

We are bullish and have developments in Texas and Georgia, where Americans continue to move and the environment remains amenable to investment and development. Some major Northeastern cities facing high taxes, complicated regulations and oppositional environments make it harder for investors and developers to supply the housing and infrastructure so desperately needed in those very locations.

What’s going to be your biggest expense in 2025?

Labor. Given that we will be in active construction on several projects, skilled labor is likely to be our largest economic input.

How’s the financing climate for new development and redevelopment — hot, cold or just right?

Defrosting. The last two years have been paralyzed by historic interest rate hikes and political uncertainty. Settling interest rates and political clarity along with price plateaus in other asset classes will likely see large investors come off the sidelines for real estate.

What are your predictions for the mayor’s City of Yes, especially given the controversies within the Adams administration?

It’s a powerful idea to tie infrastructure and housing needs to environmental sustainability as an economic catalyst. Development, infrastructure and industry incubation take time, so we don’t yet know the impact of the initiative.

Do you still like Eric Adams? (Did you ever like him?)

I don’t know Mayor Adams well.

Lightning Round:

Your social media of choice?

Instagram.

AI: Helpful in CRE or a fad?

Helpful (think of brokerage, for example).

Last movie you saw in a theater?

“Inside Out 2.”

You’re going on a six-month expedition into the Amazon rainforest. What’s your last meal before you get on the plane?

Veal saltimbocca with a side of angel hair pasta in a garlic/white wine sauce.

Will interest rates be below or above 4 percent on July 1, 2025?

Above.

Tesla or BMW?

BMW.

If you could partner with one person in the business on a property, who would it be?

Jonathan Gray.

What are you tired of talking about?

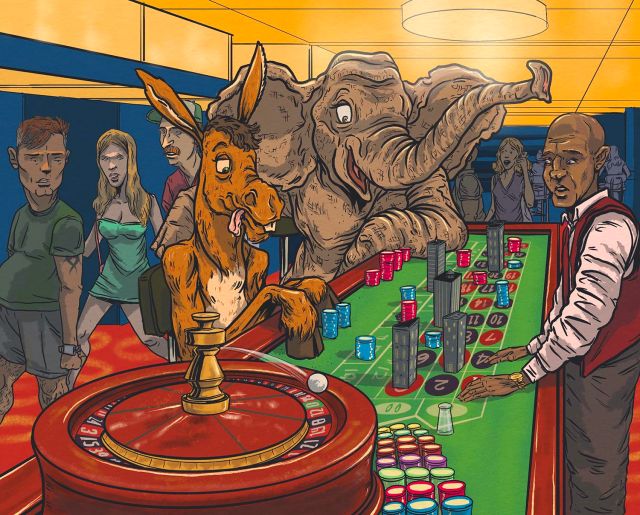

Electoral politics.