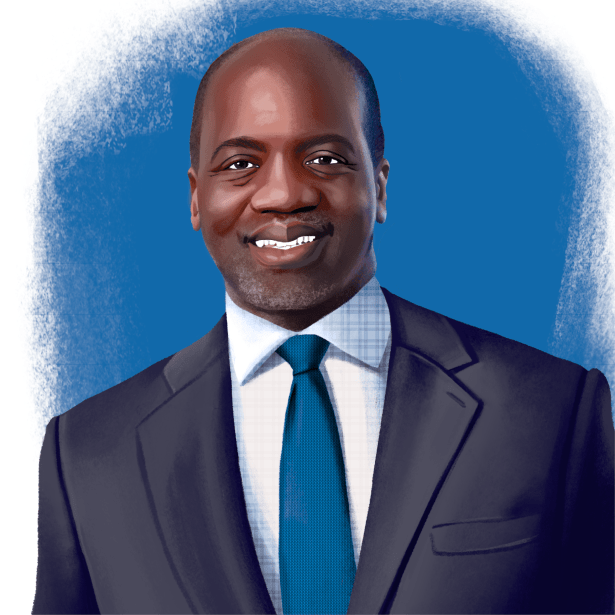

Meredith Marshall

Co-founder and managing partner at BRP Companies

Are you going to buy in `25? If so, what asset class?

Yes, we plan to continue purchasing in 2025, remaining bullish and focused on multifamily development opportunities within key markets exemplifying high population and employment growth, including the Atlanta and the DMV regions as well as across our home base of New York City.

Is there a single “good” sign you see in a distressed property that makes you want to buy it?

We’re always looking toward the future, so if a property is situated within our target areas and the acquisition pricing aligns with the financial models we have created, the acquisition of distressed properties provides a great opportunity for investment and transformation.

What real estate or tax policy would you like to see from a Trump administration?

I hope to see the new administration address the housing supply and demand imbalance through the establishment of new policies that are in favor of getting additional supply developed and delivered to communities across the nation. The real estate industry will be able to better control costs and provide increased affordable housing opportunities.

Let’s talk about office. Is the worst over?

We’re currently experiencing the lowest point across the office market, and are likely to remain in this position throughout the majority of 2025.

Let’s talk about retail. What’s the kind of tenant you want?

That all depends on the specific property we’re delivering and the neighborhood it is situated within. We always seek businesses that will best align with the desires of our residents residing across properties and the surrounding communities. While our primary focus is providing quality residential offerings across the New York region and beyond, the retail component of our properties is viewed more as an amenity, driven by residents that fit the overall aesthetic and vision for each submarket we are operating within versus seeking out businesses that will pay at or above market rents.

Let’s talk about multifamily. Do you ever see yourself building normal, middle-class rentals again? What would stop you?

Our longstanding mission has been to develop housing for a wide range of income levels, from low income to market rate, with a specific emphasis on creating workforce housing. Recognizing that the majority of the country’s population and workforce fall into the middle-income category, we’re steadfast in our commitment to continuing to provide as many workforce housing units as possible in collaboration with the public and private sectors and municipalities.

Which market (outside of NYC) do you like best?

Atlanta and the Greater DMV region.

Which market (including NYC) are you most fearful of?

Any market that is over-regulated and restricting the supply of new housing stock.

What’s going to be your biggest expense in 2025?

Labor.

How’s the financing climate for new development and redevelopment — hot, cold or just right?

It’s still a bit cold, but we expect it to warm up in 2025.

What are your predictions for the mayor’s City of Yes, especially given the controversies within the Adams administration?

There may be some amendments implemented, but the City of Yes will certainly be passed.

Lightning Round:

Social media of choice?

Instagram.

AI: Helpful in CRE or a fad?

It is helpful now, and will only continue to become more instrumental as we figure out how to use it more effectively.

Last movie you saw in a theater?

“Origin.”

You’re going on a six-month expedition into the Amazon rainforest. What’s your last meal before you get on the plane?

Curry chicken.

Tesla or BMW?

BMW.

Will interest rates be below or above 4 percent on July 1, 2025?

Below.

What are you tired of talking about?

Conflict and division.