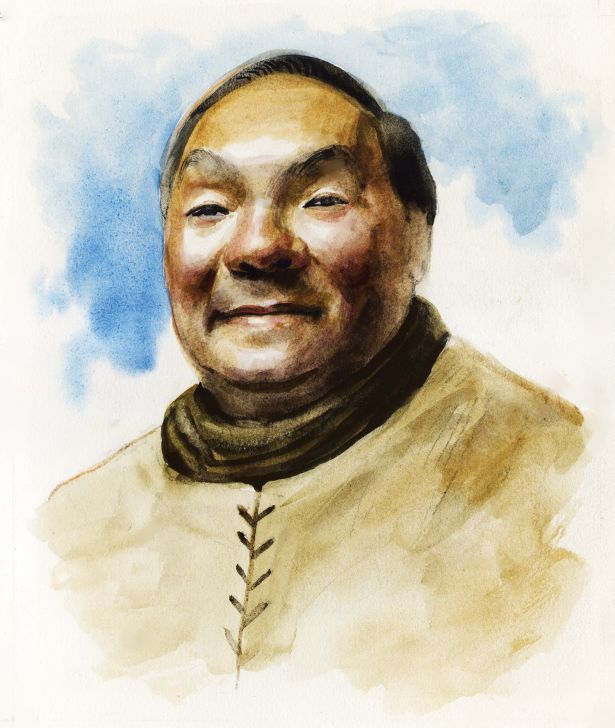

Drew Fung

Head of Debt Investment Group at Clarion Partners

Where in the capital stack are you most comfortable playing today?

Over many years and numerous real estate cycles, we have focused on what is commonly referred to as the mezzanine position. This portion of the capital stack starts around 55 percent loan-to-value (LTV) and can run up to 85 percent LTV. Mezz can be a great place to lend given the typical 15 to 20 percent equity cushion the mezz lender benefits from while being paid a significant premium to the coupon rate that a senior lender will earn. This holds true across different property types and geographies. So, we like the mezz play a lot given the ability to modulate risk. That said, to invest in mezz successfully, you need to have the right skill set — namely, the ability to do a “deep dive” on the collateral, markets and sponsor since mezzanine is closer to equity. And if things don’t go according to plan, you must be able to rely on being able to understand the inner workings of a property in detail. Again, much more than say a senior lender whose last dollar of risk is at 60 percent LTV.

What’s your best piece of advice for borrowers seeking financing today?

In turbulent times, borrowers should find a lender with an experienced team that can truly understand the business plan for the asset you are trying to finance. Savvy, veteran lending groups like Clarion that have been in the business for a long time will typically have the ability to structure their deals in a flexible way. They have seen both good and bad real estate cycles and will try to build in flexibility knowing borrowers may need time and capital to execute on a sound plan to add value.

Would you rather finance a well-established sponsor on a Class B office renovation in New York City, or the first-time developer of a multifamily project in the Sun Belt today? Discuss.

This is a great question but also somewhat of a trick question because some of the most fundamental lending pillars are based upon having an experienced, well-capitalized sponsor, lending in markets (and property types) where our own research and experience tells us the forward-looking fundamentals are favorable, and, lastly, where we can earn a good return. So, if I had to choose, I would choose the well-established sponsor on a Class B office renovation in New York City. Why? A well-established sponsor is inclined to choose their projects carefully based on experience and past success. They are also more likely to be well capitalized if there are cost overruns. Second, NYC office is familiar territory for Clarion, where we have both financed and owned, so we would not be relying solely on the borrower’s underwriting. Clarion also has a lot of experience with Sun Belt multifamily development, so we know a lot can go wrong in ground-up regardless of whether it is a hot market or not. First-time developers can learn on someone else’s nickel, not ours.

When will we reach the bottom of the market, and when will we see a thawing in the debt markets?

I’ll leave the fortune-telling to the experts, but my personal view is that there will be at least another six to nine months of low liquidity in the real estate financing markets. This is because lenders will continue to be hesitant until they are confident that the Fed is done hiking rates. My understanding is that there is a significant lag in the indicators that the Fed looks at to monitor inflation, so even if we are seeing rent rate increases in multifamily moderating now, this might not show up and be factored into Fed thinking for another two quarters.

What would you do differently during the next pandemic?

We learned a lot in the last two years, but, if I had it to do all over again, I’m not sure I would do much differently. We’ve historically favored multifamily and industrial as property types, and an overweight to those sectors served us well.

What keeps you up at night?

I tend to sleep pretty soundly, but on occasion will wake up in a cold sweat worrying about a specific deal issue. I will sometimes lie awake thinking about how the real estate finance industry as a whole will incorporate ESG into the lending metrics it uses to assess risk. At Clarion, we have made some meaningful strides forward in how we will evaluate risks such as flooding, wildfires and drought into our thinking. But there are still a lot of questions as to what data to utilize and an overall lack of standardization that I think we need to come together as an industry to agree upon, which always takes time and effort and sometimes an event (e.g. a hurricane) to gain momentum. I have been getting more rest lately now knowing that we are close to launching a new performance measurement index that tracks debt funds. This is an effort that the National Council of Real Estate Investment Fiduciaries (NCREIF) has been leading and that I have been advocating for in the industry that will make it easier for investors to track and understand real estate debt fund performance. It is aspirational as of now, but perhaps we will be able to add ESG data to the index as we build it out further.

Lighting Round: Would you rather…

Traverse Jurassic Park on foot, or relive 2008?

Relive 2008; knowing what I know now, we could earn some fabulous returns.

Be paid in crypto or Nestle Crunch bars?

Crypto.

Run a marathon or swim in the Gowanus Canal?

Swim in the Gowanus Canal.

Be a contestant on “American Idol” or be a contestant on “Survivor”?

“Survivor.” My singing is atrocious and, as a sailor, I have some formal survival training under my belt

Fight 100 duck-size horses or one horse-size duck?

100 duck-size horses.

Work in a Michelin-starred kitchen or work in a McDonald’s?

Michelin-starred kitchen; I’m a bit of a foodie.