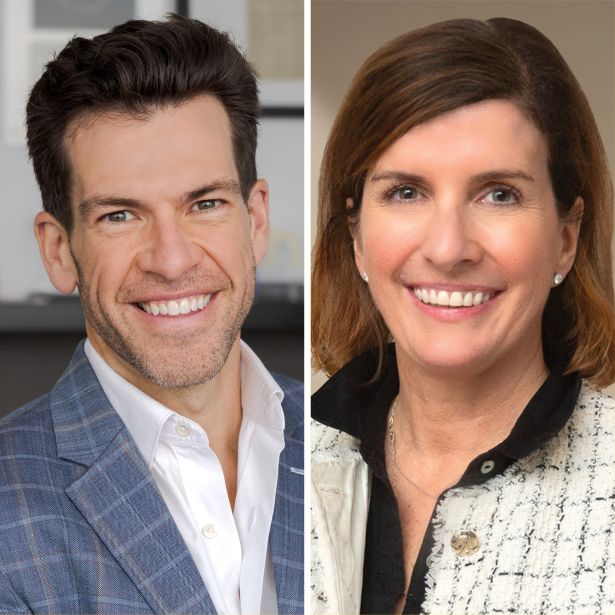

Brendan Wallace (left) and Mary Hogan Preusse.

Brendan Wallace and Mary Hogan Preusse

CEO and chief investment officer; senior adviser at Fifth Wall

After navigating a period defined by cautious venture capital deployment, Fifth Wall has emerged as a linchpin of the proptech investing ecosystem and cemented its status as a leader driving the ecosystem’s long-awaited maturation.

Brendan Wallace heralded the breaking of what he and others described as the “proptech winter” — diverging from the slower fundraising environment of recent years — citing a successful 2025 in which the firm raised more capital than in the previous two years combined. The surge was fueled by increased demand from institutional limited partners such as Public Storage, Camden and CBRE.

A driver of the firm’s investment strategy is the emergence of a “new cohort, a new class of more seasoned, more battle-hardened founders.” Wallace noted that four of the firm’s five recent investments have been with second-time proptech founders who previously led companies to exits exceeding $800 million, signaling the transition of proptech from a nascent category into a data-backed field suitable for high-conviction deployment.

The firm’s maturation is further affirmed by Mary Hogan Preusse, whose involvement Wallace described as a symbolic “geologic shift” that gives proptech a seat at the table in capital markets discussions.

“We haven’t seen something like this in a long time, and just for me as sort of an industry veteran, it is so incredibly valuable for me,” Preusse said.

She noted that the industry’s viewpoint on technology has fundamentally changed: “I think there’s a little bit more of a ‘must-have’ going on.”

Fifth Wall also reported sending back over $750 million to investors, and its influence reaches across seemingly every conceivable asset type. Its portfolio of unicorn-grade proptech companies (notably including Juniper Square and ServiceTitan) shows an industry graduating into institutional scale.

Fifth Wall is also looking outside the box in more ways than one. Wallace said proptech could be moving into the “unbuilt environment,” targeting innovation in land capital markets and entitlement processes, positioning the firm at the intersection of proptech and infrastructure investment.