- 2025

Meet the figures creating fortunes in commercial real estate amid historic disruptions

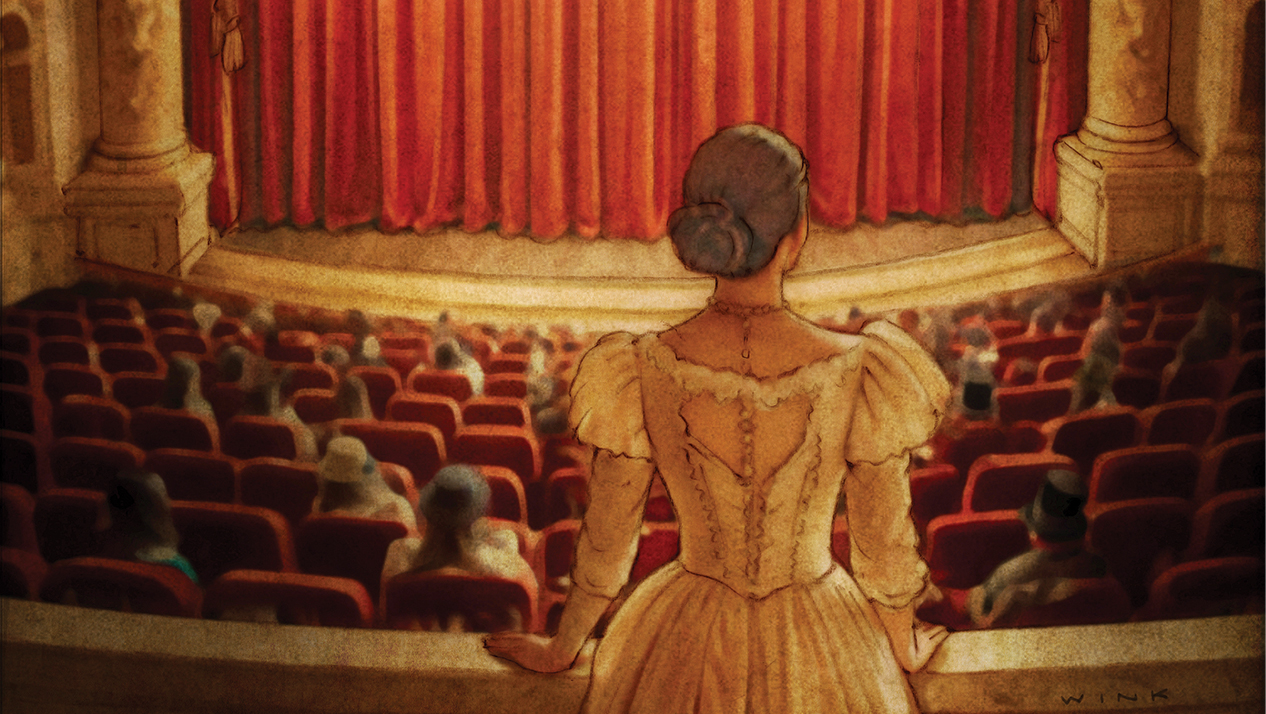

In history’s Gilded Age, fortunes were made and fortunes were lost. Rapid economic expansion and often breathtaking technological changes took hold, paired with growth, wealth inequality, plenty of political corruption, immense corporate influence and anxiety over social status. New money rushed in, while old money peered above its opera glasses at new entrants’ opulence, often disapprovingly and with furrowed brows.

Sound kind of familiar?

Those who say that America is experiencing a second Gilded Age like the one that began some 150 years ago (and that’s currently all the rage via HBO Max’s “The Gilded Age”) are not wholly wrong. It is an age of incredible opulence — for some. And few industries have experienced these dizzying disparities more than commercial real estate.

Recent years have opened a window for new money, or investors, to enter the CRE industry via a once-in-a-cycle window that’s now more than five years old. The market uncertainty that lingers follows an already dreadful culmination of unfortunate events — perhaps the equivalent of an open buggy ride down a dusty, potholed road — that included a global pandemic, historically high interest rates and a tariff war that is still unfolding.We’re also waiting to see whether President Donald Trump or Federal Reserve Chairman Jerome Powell will blink first on cutting those rates.

Meanwhile, with global trade talks ongoing, many investors are sitting on the sidelines until more clarity, and certainty, prevails.

Still, the 25 investors and investment teams on Commercial Observer’s inaugural Power Investors list are consistently generating returns on behalf of their own investors — new and old — despite the market bumps. They are listed here in alphabetical order by company name.

Unwavering in their high-conviction themes, they put in the work to ensure they’re on top. They’re also leaning into market dislocation and taking advantage of distress while it still remains via opportunistic funds. (As “Gilded Age” character Bertha Russell said, “I am taking a chance, George, I know that. But whoever achieved great things without taking chances?”)

To select these honorees, we combed through titles at the big real estate shops, family offices, sovereign wealth funds and investment banks to find who, exactly, was bankrolling the projects that pop up in CO’s pages. We contacted friends and sources, too, and dug into financial disclosures and property records where available. (Some of the names featured here would rather not be in the spotlight — we get it, it comes with their territory. But it’s what we do.)

Our investors are at the forefront of some of the top-performing platforms and funds. They’re utilizing the most successful and in-demand strategies across asset classes. They are reaping in many cases almost unimaginable returns. We tip our bowler hats to them all. —Cathy Cunningham