Retail Leasing in Manhattan Rallied in the Second Half of 2024

By Amanda Schiavo February 24, 2025 1:02 pm

reprints

A strong job market, robust tourism and the return-to-office push all helped stimulate Manhattan’s retail leasing in the second half of 2024, according to the latest report from the Real Estate Board of New York (REBNY).

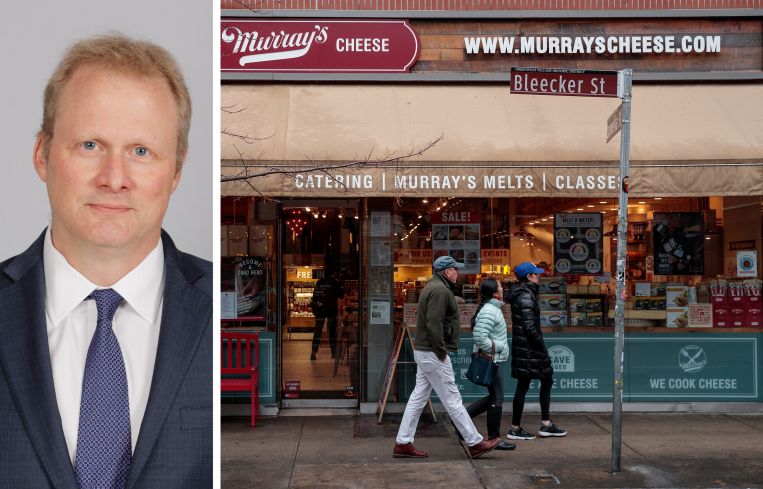

Areas including uptown Madison Avenue, lower Fifth Avenue and a segment of Bleecker Street all saw strong leasing activity in the last half of last year, according to the New York Post, which first reported on the latest REBNY data. The report examined activity in Manhattan’s major retail corridors from July to December 2024.

SoHo and Madison Avenue were the most competitive corridors in the borough, according to the REBNY data. Most of the storefronts on Madison Avenue between 60th Street and 76th Street had been leased by the end of 2024, and there was a seven-block stretch on Bleecker Street from Seventh Avenue South to Hudson Street that was also nearly fully leased.

A large driver of leasing activity came from fashion brands setting up shop in the city, which accounted for 20 percent of retail leasing in the second half of the year, according to REBNY. That included Brooks Brothers taking 9,871 square feet at 195 Broadway to return to the Financial District, and Boggi Milano’s 8,810-square-foot lease at 527 Madison Avenue.

Other areas of Manhattan saw more sporadic leasing activity in the second half of 2024. REBNY found there was less leasing in Herald Square, Times Square and along lower Fifth Avenue. But Fifth Avenue leasing could get a boost in the future as Mayor Eric Adams unveiled plans in October to redevelop a 20-block stretch of Fifth Avenue into an “iconic boulevard,” marking the first major redesign of the area in its 200-year history.

It wasn’t just leasing that was strong in the back half of 2024, as there were several notable real estate investments in Manhattan, including Acadia Realty Trust acquiring 92 and 94 Greene Street, which is anchored by Givenchy, for $44 million. Blackstone purchased a number of properties in SoHo, including 61 Crosby Street and 72-76 Green Street, as well as 465 Broadway and 415 West Broadway, for $198 million.

Retail rents were somewhat muted in the last half of the year with rent rising in only six of the borough’s 17 corridors examined by REBNY. Rents actually fell in a majority of the corridors as higher-quality storefronts were leased and thus taken off the market, REBNY noted. Additionally, the average asking rents in 16 of the 17 corridors REBNY examined remain at least 10 percent below their pre-pandemic levels.

Still, there is cause for optimism as the city moves further away from the impact of the pandemic.

“More than two years into its recovery, Manhattan’s retail market is still quite balanced, underscored by expansion by top global brands and local mainstays as well as retailers entering the market for the first time — all attracted to the resurgence of the city,” Keith DeCoster, vice president of market data and policy at REBNY, said in a statement. “The costs and challenges associated with setting up and operating a store remain daunting, but relative to prior cycles, rents remain reasonable in most cases.”

Amanda Schiavo can be reached at aschiavo@commercialobserver.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)