JLL Real Estate Capital Provides $82M Loan on Two Jersey City Apartment Buildings

Alpine Residential finished building the two apartment complexes earlier this year

By Brian Pascus February 25, 2025 4:27 pm

reprints

Alpine Residential has secured $81.95 million to refinance a pair of recently constructed multifamily properties in Jersey City, N.J., that together hold just over 200 units.

JLL Real Estate Capital supplied the five-year, interest-only, fixed-rate Freddie Mac loan, which retires existing construction debt.

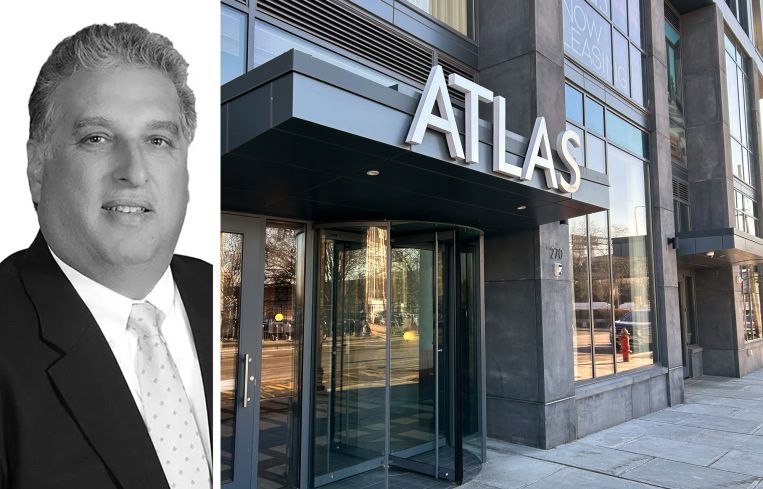

A JLL Capital Markes team of Tom Didio, Thomas E. Didio and Michael Mataras arranged the financing.

The two buildings — known as Atlas and Starling — are at 270 Johnston Avenue and 66 Monitor Street, respectively, just outside Downtown Jersey City. The buildings are near the Liberty State Park light rail station and Liberty State Park, along the Hudson River.

In a statement, Thomas E Didio praised the buildings’ proximity to both the light rail and mass transit, and said the refinancing attracted “significant lender interest.”

“We are pleased to have assisted Alpine Residential in securing permanent financing for these two high-quality multi-housing assets in Bergen-Lafayette,” he said.

Both Atlas and Starling were built in 2025, with the former containing 169 units, including 11 affordable apartments, and the latter holding 39 units, with three of those reserved for affordable units.

Alpine Residential did not respond to requests for comment.

Brian Pascus can be reached at bpascus@commercialobserver.com.