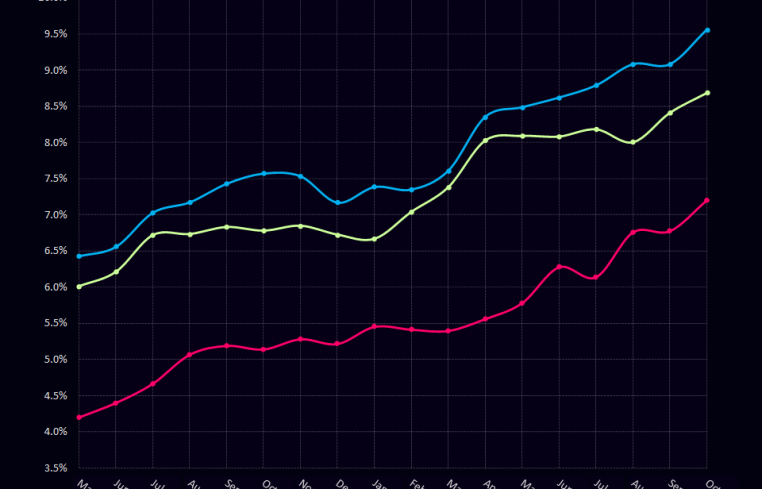

CMBS Distress Rate Climbs Higher in October to 9.6%

The CRED iQ research team evaluated payment statuses reported for each loan (securitized by CMBS financing), along with special servicing status as part of our monthly distress update. Five of the six major property types that CRED iQ tracks climbed higher in October.

The overall CRED iQ distress rate inched up in October by 5 basis points (bps) to 9.6 percent, which sets another consecutive record high. CRED iQ’s specially serviced rate added three bps to 8.7 percent. Following a flat print last month, our delinquency rate rose from 6.8 percent to 7.2 percent during October.

Following a 108-bps increase in our September print, the office segment distress rate came in flat in this report at 14.8 percent. As reported last month, the office distress rate has nearly tripled in the last 18 months.

Retail properties remain in the No. 2 slot for CRE distress with a 11.7 percent distress rate, a slight increase from last month’s print of 11.4 percent.

Right behind retail, multifamily has an 11 percent distress rate — shaving two bps during October. Multifamily has experienced the sharpest distress increase of all property types in 2024. The January 2024 multifamily distress rate was 2.6 percent, yielding a stunning 840-bps increase in the distress rate over the course of the year.

The hotel segment distress rate increased from 8.6 percent to 9 percent during October, the fourth-highest amongst all property types.

The two segments with the highest month-over-month distress rate increases are the same two property types with the lowest distress rates. Self-storage jumped from 2.4 percent to 3.6 percent, and industrial added 60 bps to hit 1.2 percent.

Two single-borrower large loan deals (CGCMT 2021-PRM2 and BX 2020-VKNG) backed by self-storage and industrial portfolios fell delinquent as they failed to pay off at their October maturity date. Consequently, the CRED iQ detailed loan statuses for both loans fell to performing matured from current in September.

Looking at the distressed loan payment status, 18.2 percent of the loans are current. Additionally, 0.3 percent of loans are attributed to late (but within the grace period) and 6.1 percent of loans were late (but less than 30 days delinquent). When we combine these three metrics, 24.6 percent of all loans were current, late within the grace period, or less than 30 days delinquent (a reduction of 100 bps from September).

The nonperforming matured category decreased in from 42.3 percent to 39.9 percent (a 240-bps decrease) for October. Meanwhile, performing matured increased from 14.5 percent in our September report to 16.7 percent (a 220-bps increase).

Analysis methodology

It’s important to note that CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-

borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae and CRE CLO loan metrics in separate analyses.

CRED iQ’s distress rate aggregates the two indicators of distress — delinquency rate and specially serviced rate — yielding the distress rate. The index includes any loan with a payment status of 30-plus days delinquent or worse, any loan actively with the special servicer, and includes nonperforming and performing loans that have failed to pay off at maturity.

Mike Haas is the founder and CEO of CRED iQ.