Once upon a time in the commercial real estate house,

Not too much was stirring, barely even a mouse.

The Federal Reserve wasn’t done raising rates

And CRE players were like “Umm, no thanks, mate.”

But the savviest players found ways to do deals

And, come late 2024, Powell gave us all the feels.

Transaction activity stirred, contracts were signed,

And seasoned lenders found moments to shine.

The distress is by no means in the rearview just yet,

But hope for 2025 seems like a pretty strong bet.

In summer of 2024, more than two years after the Federal Reserve’s interest rate hikes began, something started to change.

Market optimism (coupled with some resignation) began to stir from its deep slumber and stretch from beneath the sheets, shaking off the cobwebs of market inactivity and uncertainty, and confronting the Jerome Powell-shaped ghosts that drove us under the covers in the first place.

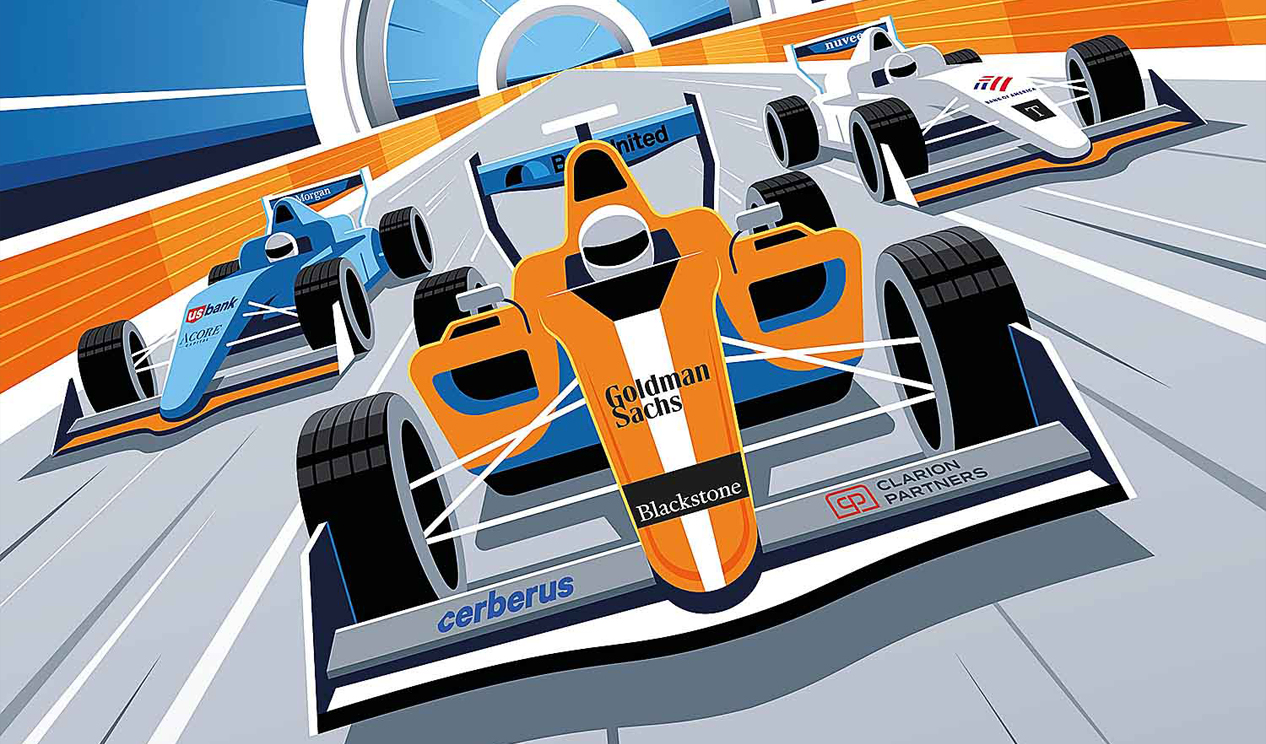

There had been pockets of activity, of course, with plenty of lenders staying in the game, but the transaction volume was choppy and often stilted. But, by midsummer, engines that had been silent, or at best sputtering, began to slowly roar into action.

Starwood Property Trust’s Dennis Schuh surmised the past year artfully in saying, “The real estate market had been holding its collective breath for a while and finally exhaled this past year with a view that the worst was likely behind us, the storm clouds were dissipating, and capital was starting to flow again.”

That exhale, so palpable it raised the hairs on the heads of Commercial Observer’s finance reporters, meant increased deal activity across the board, from refinancings to recaps to construction loans, and even to acquisition financings as the bid-ask spread narrowed.

Anticipated interest rate cuts were partly the fuel, of course, coupled with an acknowledgement that some transactions — kicked down the road and extended out so long that a new presidential cycle was about to begin — could no longer be delayed. The backseat whines asking “Are we nearly at the bottom yet?” dissipated, and people decided now was as good a time as any to restart their engines.

The racetrack loop that commercial real estate lenders have been on these past four years has required all-wheel drive, with hands firmly on 9 and 3. If we thought COVID sent enough unexpected twists and turns our way, the elevated interest rate environment was the mechanic’s golden retriever that escaped from the crowd and left us all figuring out how to swerve around it.

As that much-anticipated activity returns, plenty of obstacles remain. After all, there’s the hope of further interest rate cuts, but they’re not guaranteed; portfolio issues remain, and have to be dealt with; keys have to be taken back and hard discussions need to take place; and who the heck knows what will become of Class B office (STILL!)? This race to the end of dislocation and distress isn’t done, not yet at least.

As the engines behind every transaction, our lenders have a unique perspective. They can see when a deal, property or business plan needs fine-tuning. They know when to pump the brakes, or wave the yellow caution flag on extensions when enough is enough. They know the blind spots that could end in a double apex for them, or for the borrower.

With that in mind, this year’s Lenders Magazine is a snapshot of our lenders’ individual market views from their driver’s seats, whether they’re bank lenders, nonbanks, CMBS lenders or C-PACE shops. Our lenders were interviewed at a rather interesting time in the market, amid a tale of two cities in many ways as the industry moves ahead with optimism for 2025 while simultaneously managing through all of the legacy issues accumulated over the past four-plus years.

We can’t think of a better group to tell us what they’re seeing, and what we can expect in the year to come. And, with increased transaction volume being something that they all agreed upon for 2025, ladies and gents, start your engines.