Distress Rate Hits All-Time High for CRE CLOs

The CRED iQ research team dove deep into the CRE collateralized loan obligation (CLO) ecosystem this week.

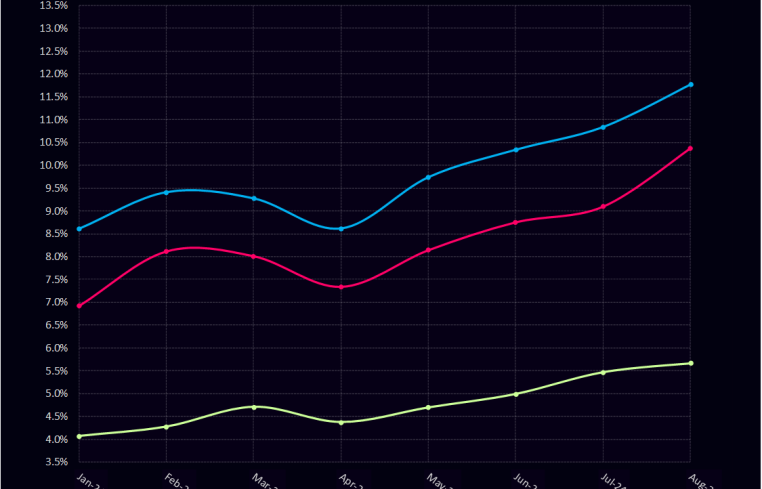

We were interested to see how the market has evolved since our July report, and found that the CRED iQ distress rate reached 13.1 percent at the close of the third quarter — a whopping 277 basis point increase from the previous quarter’s close, and a new record for the CRE CLO category.

The CRED iQ distress rate includes any loan reported 30 days delinquent past the loan’s maturity date, a specially serviced loan, or a combination of the two. We also examined the most recent property-level net operating income figures today and compared them to underwritten expectations for that property.

Given the rapid surge in interest rates, these floating-rate CRE CLO loans have shown significant declines in debt service coverage ratios (DSCR). Approximately 53.9 percent of the properties within the distressed CRE CLO sector have reported a lower DSCR compared to their underwritten DSCR. These numbers are based on the underwritten “as is” DSCRs and also net operating income (NOI). CRED iQ’s analysis found that 62.3 percent of all distressed CRE CLOs are operating below a 1.00 DSCR.

Removing the interest rate variable, CRED iQ data uncovered that 41.8 percent of all CRE CLO distressed loans perform below their underwritten NOI levels, with NOI being a key variable in calculating a loan’s DSCR, which ultimately then determines the strength and creditworthiness of a given loan.

From a segment perspective, office perhaps unsurprisingly leads the distress, logging an 18.5 percent distress rate, compared to 17.1 percent at the close of the second quarter. With that said, office sector distress is still below its 2024 high of 21.3 percent in February.

Multifamily saw a 13.7 percent distress rate in the third quarter, flat compared to the second. The segment spent most of the quarter at elevated levels as high as 16.4 percent in August, before a 270-basis point reduction in the September print.

Retail (11.1 percent) and hotel (8.5 percent) round out the top four asset classes. Self-storage scored another 0 percent distress rate, and industrial was only 1.1 percent. Showing upward trending, hotels saw a 460-basis point increase during the third quarter, followed by retail which logged a 220-basis point increase.

Looking across payment status, 29.4 percent of loans are performing matured, with another 34.9 percent are nonperforming matured, meaning that 64.3 percent of the CRE CLO loans in our study are past their maturity dates.

Analysis scope and methodology

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Our team examined $72.4 billion in active CRE CLO loans, many of which were originated in 2021 at times where cap rates were low, valuations were high and interest rates were low, and they’re now starting to run into maturity issues given the spike in interest rates.

Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto and TPG. The vast majority of the $79.1 billion in CRE CLO loans are structured with floating rates with three-year loan terms and include loan extension options if certain financial hurdles are met.

Mike Haas is founder and CEO of CRED iQ.