Presented By: Reonomy

Path to prosperity in a post-Covid CRE economy: 4 experts discuss

Subject matter experts from the Federal Reserve bank, NYU Schack Institute, Carlyle Capital, and Reonomy joined a recent event to discuss Covid recovery and the implications for professionals within CRE

Almost a year and a half into the COVID-19 pandemic, the commercial real estate community, like much of the rest of the world, stands at a crossroads.

Previous concerns, like the decline of retail, were exacerbated, while new ones, such as the fall of the office market, joined them. Work-from-home, a rarity pre-COVID, served as a life-saving necessity and potential category killer as discussions of office-to-residential or office-to-life-science conversions continue to grow in frequency and importance.

The sharpest minds in CRE, then, which might previously have spent their time considering the best and straightest routes to prosperity, are now contemplating strategies for survival.

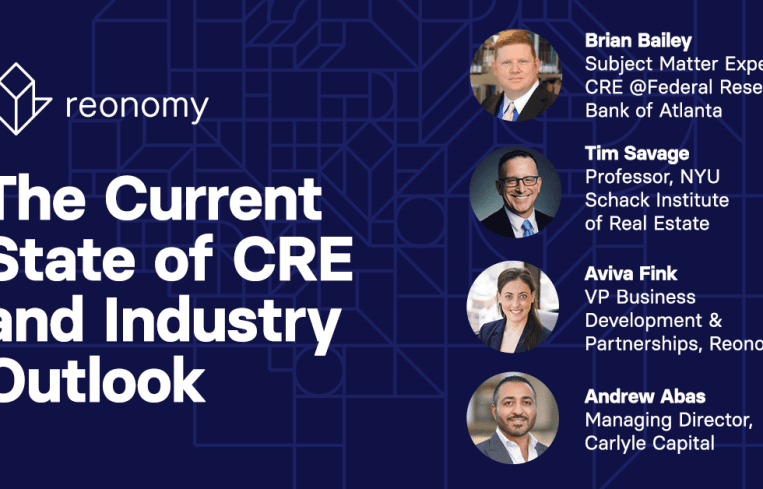

A recent webinar hosted by Reonomy delved into these topics, looking at where the pandemic has left the commercial real estate market economically and structurally, and discussing which tools and strategies will help the industry recover and evolve the quickest.

On July 14, “The Current State of CRE and Industry Outlook” panel featured insights from Brian Bailey, a CRE subject matter expert with the Federal Reserve Bank of Atlanta; Tim Savage, a professor at the NYU Schack Institute of Real Estate; Andrew Abas, managing director at Carlyle Capital; and Aviva Fink, vice president of business development and partnerships at Reonomy.

U.S. economy faltered pre-COVID

While much has been made of the COVID-caused recession, Savage noted that the economy was already shaky in 2019, with the yield curve already having turned negative and the Federal Reserve feeling the need to intervene that summer.

“Healthy economies do not have negative yield curves and do not require Fed intervention,” said Savage. “All of this occurred before COVID entered our lexicon. We need to reflect on the fact that the U.S. economy was not necessarily on sound footing going into the pandemic.”

Approaches to data are changing

In this era of data dominance, CRE professionals are trying to determine how to best use data to lift us out of the country’s economic malaise. According to the panelists, the evolution of approaches to data brings both advantages and challenges.

Fink noted that there has been an overall change for the better in how CRE professionals think about data.

“Our clients are starting to evolve their thinking,” Fink said. “Instead of saying, ‘Show me everything in the Los Angeles [metropolitan statistical area],’ they’re saying, ‘Here’s a unique shape, or polygon of properties I care about with very distinct attributes. Tell me everything you know about these properties.’ It’s a wonderful evolution of data strategy that we’re starting to see companies adopt. We are seeing, in real time, the evolution of dependence on, or valuing of, data.”

Fink believes that adopting this strategy will, in turn, strengthen other areas of business.

“This makes me very hopeful that companies will get smarter not just about the third-party data they harness, but also about the first-party data they track,” said Fink. “That way, they can improve upon both their underwriting and how they think about managing their fixed expenses.”

Changing times lead to inflation confusion

Fink asked Savage whether we should consider rising inflation to be an important aspect of our recovery.

“Generating inflation has proven to be a challenge,” said Savage. “The U.S. economy is structurally different now than it was during the inflationary belt that is often talked about during the 1970s — the period of highly variable and unexpected inflation that blew the bond market away. There have been some really important structural changes, such as how the U.S. economy is not as dependent on foreign energy today, which makes us less at risk from wars in the Middle East.”

A rare upside

Abas, while discussing trends on the lending side, noted that COVID has led to one positive change for CRE, as sponsorships are much stronger coming out the pandemic than they have been in the past.

“What we’re seeing from the people that are buying and investing in real estate today on the commercial side is an overall increase in sponsorship quality, because you have to have the balance sheet to stomach the uncertainty,” said Abas. “Before, you could safely assume, ‘If I buy this property, make some improvements, then sell it based on my constant cap rate, I can make some money.’ Today, that stabilization plan is much, much different. In general, we’re seeing a very high increase in sponsorship quality compared to before COVID.”

Secondary markets are growing

Fink noted that, according to Reonomy data, there’s been a significant uptake in secondary markets like Cincinnati, Columbus, and Ann Arbor for both core commercial real estate asset types and single-family.

“Secondary cities are interesting locations,” echoed Savage. “The Raleigh-Durham area is a great place to think about from an investor perspective, because it has a lot of the things you would think could drive outsized returns: great school system, really good weather other than August, and, setting aside traffic issues, a business-friendly environment.”

Based on the data, Bailey agreed, while noting that some recent trends might not be advancing as far as people thought.

“Firms moving out of the Northeast to lower-cost markets, specifically north and central Florida, seems to be accelerating,” said Bailey. “But think about what hurricanes have done to the insurance climate in Florida. While on the surface, the tax dynamics are night and day compared to New York City, at the same point, there are significant costs one wouldn’t anticipate in Florida in the form of hurricane insurance, wind insurance, flood insurance, etc. It’s become pretty costly. So, while there’s still significant migration into Florida, I think you’re going to start seeing some folks being priced out. Florida has benefited over the last three or four decades, but now you’re starting to see the likes of the Raleigh-Durham, Charlotte, and Nashville areas beginning to rise.”

It can be challenging to try to draw specific conclusions regarding the pandemic’s effect on CRE and the economy at this point, especially since the pandemic remains an ongoing concern. But one key takeaway from this panel is that CRE is in flux, and those most likely to prosper in the eventual post-COVID era are those who embrace CRE data and trend analyses that have become increasingly important to the industry since March 2020.

The Current State of CRE & Industry Outlook is part of a quarterly series, bringing together industry experts from across CRE to discuss US commercial real estate markets and key investment trends. To view the full recording of our most recent event, click here.