We sometimes hear about “relationship lending.” But not so much about the other side of the coin—relationship lending gone wrong. Consider this anecdotal account of a fictional bank we’ll call “XYZBank”—an institution that found its way into a California construction loan in order to grow a relationship, but ended up killing that relationship instead, thanks to their difficult approach to loan administration. Details have been changed to protect the guilty.

The transaction started out as a great match. XYZBank’s senior management in Asia already had a relationship with the new borrower and its preferred equity investor. The development, a phased mixed-use project in a major California city, made a lot of sense. It would lead to significant follow-on lending assignments. So when an opportunity came for XYZBank to take a good chunk of a new construction loan to the borrower, they seized the opportunity.

Then XYZBank started its due diligence. The borrower had already negotiated a number of complicated leases, with full involvement and sign-off by the lead lender, which had provided interim financing and would stay in the deal and continue to administer the new loan. But XYZBank had lots of questions and lots of concerns. These all required extensive discussion, none ultimately leading to any amendment of any lease or anything else. All title work was done over. Surveys needed to be recertified, engineers’ reports fully redone.

And the loan documents required a substantial amendment, because XYZBank decided the previously negotiated transfer restrictions, lease approval procedures, guaranties, single-purpose entity provisions, construction approval provisions and the like in the interim documents were too borrower-friendly. Almost everything needed renegotiation.

Eventually the construction loan closed and XYZBank came into the deal. The project moved forward. Though not happy about the lease approval procedures, the borrower complied. Every new lease went through a full vetting process by XYZBank, in addition to the lead lender’s regular lease reviews. XYZBank expressed all kinds of concerns about the terms of every lease, the borrower’s strategies, plans for public space in the project, anything else the borrower presented. The approval process required numerous conference calls to go over questions and concerns, producing delays and sometimes even a risk of lost tenancies.

Just as in the original closing of the loan that brought XYZBank into the deal, XYZBank wasn’t willing to rely on the approvals, competence and exercise of judgment by the lead lender. The process became very difficult. When the loan documents gave the lenders approval rights, XYZBank exercised its rights with extraordinary care and diligence, revisiting every borrower decision along the way.

Over time, it became clear that XYZBank’s original premise to participate in the deal was absolutely correct. The project was terrific. The borrower was doing a great job in executing its business plan, leasing up space, and getting ready for the next phases of the project—a much larger office building and a hotel. Rental income was coming in higher than projected. The borrower was able to trim back some required public improvements and complete them under budget and ahead of schedule. A local university had taken an awkward corner of the project off the borrower’s hands, which the university would now develop as a small research lab that made the rest of the project work better.

The borrower accelerated some of its further development plans. As part of that, the borrower recognized it would need more financing, sooner than originally anticipated. The borrower put together a new loan package, requiring a larger group of banks. The lead lender would again stay in the deal.

The borrower was actively involved in choosing the banks in the group. Plenty of banks wanted to participate, as the project was well known and attractive at this point.

XYZBank wanted a piece of the next phase, too. That was the main reason it had come into the deal. But when the lead lender and the borrower figured out the final allocations, a few additional lenders had come in and the lead lender took a larger than expected piece. Unfortunately, there just wasn’t enough loan left to let XYZBank take a piece. XYZBank would not achieve its original goal of further building its relationship with the borrower. Other banks would have that opportunity instead.

One might say XYZBank lost its participation opportunity months earlier when it made the closing process, and then loan administration, incredibly painful for the borrower. By doing that, XYZBank had already killed the relationship it wanted to grow.

But maybe XYZBank was right. Maybe the loan closing and administration did call for the level of scrutiny and care that XYZBank brought to the entire process. Maybe the lead lender was too kind and gentle, letting the borrower get away with things. Maybe XYZBank’s tough questions really did need to get asked—though ultimately none of them led to any visible change in any element of any legal document, the project itself, or its success.

XYZBank’s involvement in this loan started out, though, from the premise that XYZBank had a pretty high opinion of the borrower, and wanted to grow that relationship. If all of that was true, XYZBank might have tried a little harder to play well with others.

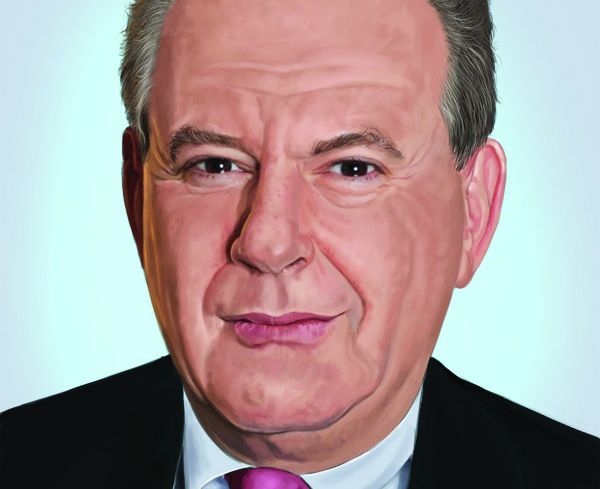

Joshua Stein is the sole principal of Joshua Stein PLLC. The views expressed here are his own. He can be reached at joshua@joshuastein.com.