Queens Set to Boom in 2015: Reports

By Jane K. Callahan February 3, 2015 4:39 pm

reprints

Queens is increasingly becoming a hot spot for commercial and residential property investments, according to a recent sales report by Ariel Property Advisors provided to Commercial Observer as well as a survey of commercial developers and builders by CO and Anchin, Block & Anchin, which was meant to assess growth opportunities in real estate in New York City and beyond.

Driving the increased popularity is the city’s burgeoning technology industry, Roosevelt Island’s Cornell Tech campus development, and of course, record-smashing residential rents in boroughs outside of Queens.

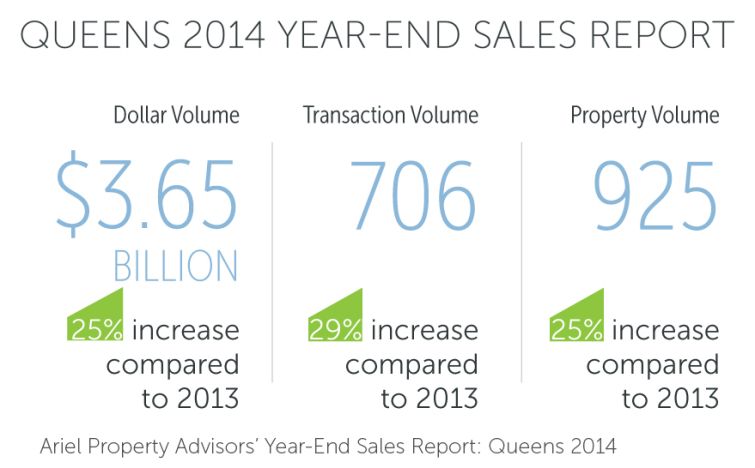

Investment property sales in Queens jumped to $3.65 billion in 2014, a year-over-year increase of 25 percent, according to an annual sales report by Ariel.

And last year’s more than $1 billion in development site sales—a 48 percent rise in dollar volume over 2013—made up almost one third of all sales dollars spent on investment properties in the borough.

Investment sales transactions in Queens increased by 29 percent to 295 from 2013.

Indeed, the survey conducted by CO and Anchin found that 66 percent of respondents believe Queens is “the next big thing.”

Marc Wieder, a partner at Anchin and co-practice leader of the firm’s real estate industry group, attributed the spike to limited availability elsewhere. With the rising cost of office space in Manhattan and parts of Brooklyn, Queens has proven to be an attractive alternative for companies looking to accommodate large work forces. Long Island City in particular has gotten attention; the Standard Motor Building sold for $110 million last year after going for $70 million just four years prior.

It’s not just companies that are seeing the area’s potential. Anchin’s survey revealed that while the 216 percent increase in Queens office sales from 2013 show a trend, “a significant portion of new projects now coming online and in the pipeline are primarily slated for condominiums,” said Daniel Wechsler, vice president of Ariel Property Advisors, in a prepared statement.

According to Ariel’s annual sales report, multifamily transactions rose 44 percent, and the number of properties traded increased by 39 percent, which include a $216 million portfolio sale of 53 buildings consisting of 1,270 units in Kew Gardens in September 2014. The next month, a 215-unit Astoria multifamily building at 12-27 Broadway sold for $88.5 million, which breaks down to over $600 per square foot.

Mr. Wieder also noted that in the survey conducted by Anchin and CO, 58 percent of survey respondents felt that commercial tenants are increasingly looking to sign longer leases due to the strong economy, which makes Queens’ relatively low rents even more enticing.

“Tenants know New York City rents haven’t declined in years, they only increase,” said Robert Gilman, a partner at Anchin and co-practice leader of the firm’s Real Estate Industry Group. “So they’re on board to sign up for longer leases to protect themselves from rent hikes.”

Mr. Wechsler said that while Long Island City is the most popular neighborhood in the newly minted borough du jour, two strong runners-up are Sunnyside and Forest Hills, largely because of an array of transportation options and airport accessibility.

For residential investments, “everything will keep pushing east from Astoria to Long Island City, Sunnyside, Jackson Heights and Elmhurst,” Mr. Wechsler said. “Any neighborhood in northwest Queens is a solid investment.”

Mr. Wechsler also said he doesn’t see the scramble for office space slowing down anytime soon.

“The market is just starting to mature in Long Island City, Court Square and Queens Plaza. There’s talk of another rezoning which will include mandatory affordable housing as well as mandatory affordable commercial space,” Mr. Wechsler said. He also noted that Cornell University has already broken ground on a 20-year plan to build out its technology campus on Roosevelt Island, which he anticipates will have a big impact on Long Island City.

“There will be a lot of spill out from that campus, including tech startups that will head east for cheaper, cooler office space rather than west to Manhattan, where it’s more expensive,” Mr. Wechsler said. “Even traditional Manhattan landlords are buying up buildings in Queens.”

Results of the survey released by Anchin and CO supported this claim; 66 percent respondents felt the tech industry is looking to Queens for office space. Mr. Weider said this is likely due to the availability of common areas and entertainment space—features popular with tech startups but that come at a high premium in Manhattan.