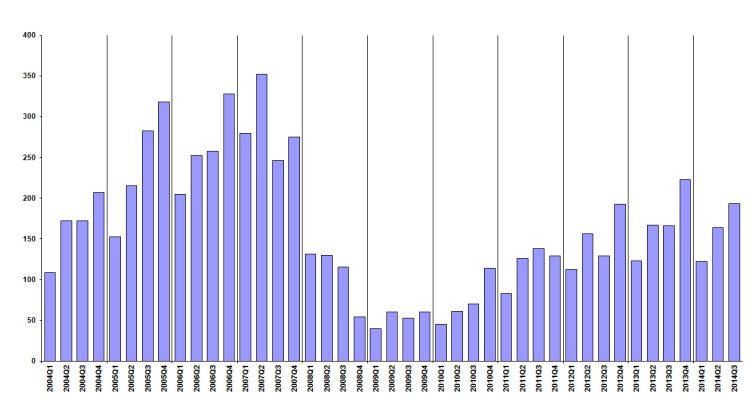

Commercial Loan Originations Continued to Climb in the Third Quarter

By Damian Ghigliotty October 28, 2014 3:00 pm

reprints

Commercial real estate loan originations in the third quarter were up 16 percent from the same period last year and up 18 percent from the second quarter of 2014, the Mortgage Bankers Association reported today.

That included a 41 percent year-over-year increase in the dollar volume of multifamily loans, as well as a 22 percent increase for industrial loans, an 11 percent increase for office loans, an 11 percent increase for retail loans and a four percent increase for hotel loans.

“Commercial real estate borrowing and lending continued at a strong clip in the third quarter,” Jamie Woodwell, MBA’s vice president of commercial real estate research, said in a written statement.

“Low rates coupled with growth in property incomes, property values and sales transactions have pushed year-to-date commercial and multifamily mortgage originations five percent above last year’s pace,” he added.

Healthcare property loans bucked the trend, with a 43 percent year-over-year decrease, according to the industry group’s research.

The dollar volume of GSE loans increased by 118 percent from the third quarter of 2013, while CMBS loans saw a 47 percent increase, and life company loans saw a one percent increase in the same period.

Bank loans, meanwhile, saw a 16 percent year-over-year decrease in dollar volume, according to the MBA report.

The Mortgage Bankers Originations Index is based on a quarterly average of 100 and does not include dollar amounts.