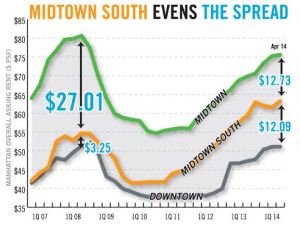

The number 12 is all around us: 12 hours on the face of a clock, 12 months in a calendar year and 12 inches in one foot. In the current Manhattan real estate market, the number 12 represents the overall asking rental spread between Downtown Manhattan and Midtown South and also between Midtown South and Midtown. To be more exact, at $75.59 per square foot, the overall average asking rent in Midtown is $12.37 more than Midtown South’s $63.22-per-square-foot average. However, Midtown South is $12.09 per square foot higher than Downtown Manhattan average asking rent of $51.13 per square foot. However, this has not historically been the case.

The number 12 is all around us: 12 hours on the face of a clock, 12 months in a calendar year and 12 inches in one foot. In the current Manhattan real estate market, the number 12 represents the overall asking rental spread between Downtown Manhattan and Midtown South and also between Midtown South and Midtown. To be more exact, at $75.59 per square foot, the overall average asking rent in Midtown is $12.37 more than Midtown South’s $63.22-per-square-foot average. However, Midtown South is $12.09 per square foot higher than Downtown Manhattan average asking rent of $51.13 per square foot. However, this has not historically been the case.

Just 12 months ago, Midtown was only $10.45 per square foot higher than Midtown South. But the asking rent increases in Midtown outpaced those of Midtown South over the last six months. Midtown’s overall asking rents are up $3.75 per square foot since October 2013, compared to a $0.60 per square foot increase in Midtown South.

Despite the current spread widening between the two markets, the difference in overall pricing during the last rising real estate cycle was significantly higher. From 2007 through 2008, Midtown asking rents were an average of $24.50 per square foot higher than Midtown South.

In the past 12 months, there has been a minimal change in the difference between Midtown South and Downtown Manhattan asking rents, as the former averages $11.50 per square foot higher. This gap has been widening between the two submarkets during the current bullish real estate cycle, as both markets were within $3.00 to $4.00 per square foot of each other from 2007 through 2010.

The tightening of the Midtown South office market, led by five consecutive years of positive absorption, has widened the pricing gap with Downtown Manhattan and narrowed it with Midtown. But how long will this last as the other two markets take off?