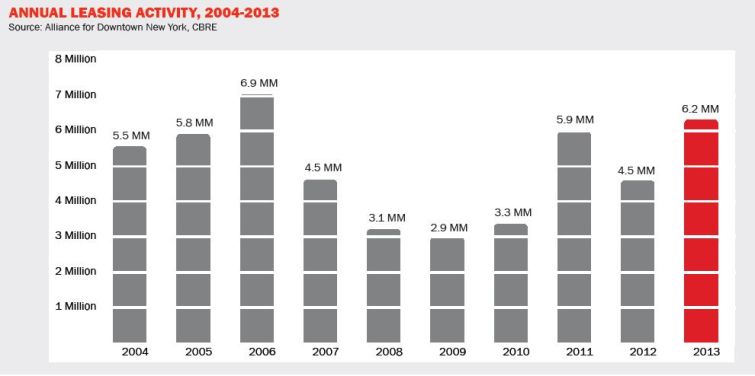

Lower Manhattan Commercial Leasing Hits Five-Year High [Updated]

By Lauren Elkies Schram February 12, 2014 12:44 pm

reprints

![Lower Manhattan Commercial Leasing Hits Five Year High [Updated] Leasing Activity in Lower Manhattan](http://observer-media.go-vip.net/wp-content/uploads/sites/3/2014/02/annualleasingactivty1.jpg?w=300)

Commercial leasing in lower Manhattan was strong in the fourth quarter last year, according to a new report from Alliance for Downtown New York, marking the best-performing quarter since 2006.

Fourth-quarter leasing activity in the Downtown Manhattan market was at 2.2 million square feet, up 46 percent from the prior quarter and 82 percent year-over-year, the report indicates. That was also more than double the five-year average.

Leasing activity was bolstered by relocations and expansions in the technology, advertising, education, media and information sectors, the report notes.

Tenant relocations accounted for 42 percent of the leasing activity in 2013, up from 27 percent in 2012.

In another recent report, the Alliance found that leasing to post-secondary education tenants downtown increased last year by more than 80 percent since 2004, Commercial Observer reported last month.

Lower Manhattan has been undergoing a transformation, particularly because of the influx of Pace University students as well as other residents.

Despite all of the leasing activity, the influx of space—like the availability of 1.2 million square feet at 4 World Trade Center—drove up the vacancy rate in 2013 to 12.2 percent, 3.4 percent over 2012’s rate.

Office rents were on the rise, with the average reaching $48 per square foot in the fourth quarter, up 5 percent from third-quarter 2013 and 22 percent year-over-year.

Retailers have been trying to keep pace with the new mix of tenants and the increase in foot traffic. As a result, 83 new stores and restaurants opened in 2013, up 8 percent from the year prior. In the next two years, 1.5 million square feet of retail—a combination of space that has been repositioned and projects in the pipeline—is scheduled to open.

Update: This story has been edited to exclude retail rents.