The Power 100

By Michael Woodsmall May 3, 2011 1:00 pm

reprints

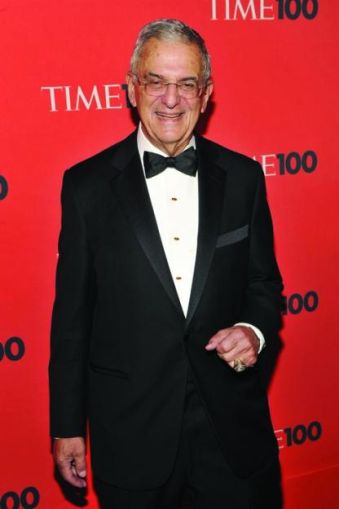

Chairman-CEO and managing director, respectively, of the Shorenstein Company

Shorenstein Properties is in a league of its own when it comes to raising equity. Last month, the San Francisco–based private real estate management concern put the lid on an investment fund—its 10th, in fact—valued at $1.23 billion. No doubt, a goodly portion of that capital will be focused on scooping up office properties in New York, a city that the company penetrated with zeal 10 years ago under Mr. Shorenstein’s leadership (Mr. Portner’s their guy in the Eastern U.S.). With 14 Wall and 450 Lex already in its portfolio, expect big acquisitions in the firm’s near future.

Speaker of the New York City Council

No public official has been quite so vocal a critic of Wal-Mart’s entry into New York as Ms. Quinn. “Wal-Mart is something I am not supportive of,” she said plainly back in December. Since then, she’s met with executives at the retail behemoth and watchers say she is trying to strike a middle ground. If the country’s largest retailer does secure entry into the city, it will no doubt signal a rush of new real estate activity across the boroughs. That is, if Ms. Quinn, a 2013 mayoral hopeful, allows it.

President of CW Capital

When the economy tanked, Mr. Spetka of CW Capital Asset Management came running. As a “special servicer,” the company has been behind the complicated financial restructurings of some of the city’s most mammoth properties, including Stuyvesant Town and Peter Cooper Village, Riverton and the W Hotel Downtown. Slowly but surely—and very quietly, too—the group is becoming a big player.

Founder and managing directors, respectively, of Jamestown Properties

For the 27-year-old Jamestown Properties, moderation has been a guiding light, and never more so than during this latest economic cycle. For Messrs. Kahl, Bronfman (pictured) and Phillips, the strategy has paid off. While inching toward what may well be a whopping $1.9 billion sale of its 2.9 million–square–feet building at 111 Eighth Avenue to Google, the owner of more than 80 U.S. properties is also swooping up assets across the country.

President of BLDG Management

“I can tell you he’s licking his chops about buying property in the next few months,” one colleague of Mr. Goldman’s told The Observer back in 2008. It was an apt assessment of the mega-private mega-landlord footing the bill at some of No. 31 Larry Silverstein’s developments at ground zero. Indeed, the magnate has been buying properties like 1372 Broadway at a deep discount since the recession struck and seems to be continuing his brisk pace with no immediate plans to slow down.

CEO of the Feil Organization

Like Lloyd Goldman (No. 29), Mr. Feil is one of the “New York guys” who repeatedly helms some of the biggest deals in the city while remaining fairly anonymous. He was a part of the team that bought the Sears Tower in Chicago, and his company owns local properties like 200 West 57th and 488 Madison. Most notable, however, was his role in the $590 million purchase of Worldwide Plaza in 2009.’

President and CEO of Silverstein Properties

From his office at 7 World Trade Center, Mr. Silverstein has established himself as a sort of patriarch of downtown. He continues cheerleading for the World Trade Center site, including inking a major lease with the city at 4 WTC; he’s also signed a number of nonprofits at 120 Wall Street. With discernible progress on the WTC towers, which are set for completion in 2013, he has his hands on some of the city’s only large available Class A office space.

Vice chairman and CEO of Rudin Management Company

After a rush of refinancing between 2006 and 2008, the relatively debt-free Rudin Management Company swung back into business, including its push for luxury condos at St. Vincent’s Hospital in Greenwich Village. But like most family-owned real estate companies, Rudin has remained cautious, choosing to renovate existing buildings, rarely selling assets and only acquiring the best properties for some meaty leases, including the NFL in 345 Park last summer. Touchdown!

Chairman-CEO and president, respectively, of Studley

Under the leadership of Messrs. Steir (pictured) and Colacino, Studley landed the city's two largest deals of 2009 (242,464 square feet for Wachtell, Lipton, Rosen & Katz and 230,000 feet for Ralph Lauren). Last year, the firm inked a 260,000-square-foot office deal for Tiffany & Co. So what does a tenant-rep firm like Studley do to top itself in 2011? With the economy looking sunnier, we're betting on much more of the same.

Head of U.S./Europe Real Estate at Angelo, Gordon & Co.

It was in early 2010 that Keith Barket, Angelo, Gordon’s longtime real estate head, and Adam Schwartz undertook a joint venture with Extell Development to purchase the Helmsley Carlton House Hotel for $170 million. Only nine months later, Barket died of stomach cancer, leaving Mr. Schwartz to guide Angelo, Gordon’s stealth real estate ship.

President of the Canadian Pension Plan Investment Board

The future of more than 17 million graying Canucks rests with New York real estate. The fund, paid into by Canadian taxpayers, is entrusted with a whopping $140 billion in funds, including at least $8 billion for investment in real estate (in Canadian dollars, now worth slightly less than the greenback). It burst onto the scene in 2010, buying a 45 percent interest in SL Green's 1221 Sixth Avenue for $576 million. An Ontario pension fund has also invested in Related's Hudson Yards project.

Senior managing directors and chairman, respectively, at Eastdil Secured

Mr. Harmon and his colleagues, Messrs. Spies (pictured) and Lambert, have the answer to one of the must-buzzed-about questions of last month: Who is the buyer, perhaps famous, of the storied Chelsea Hotel? Eastdil Secured acted as the broker, but have, thus far, refused to reveal his or her identity. It is as close to a mystery as we can hope for in the world of real estate, and the powerful trio is at the root of it. All the while, they’ve been inking other deals, like a $2 billion half-stake at 1633 Broadway.

CEO of Brookfield Properties

Barely four months into a young year, Brookfield is already busy. In January, the publicly traded landlord purchased a stake in General Growth Properties valued at $1.7 billion, and in March it signed two huge leases at 2 World Financial Center. The largest downtown landlord, with 12.9 square feet, Brookfield is also planning one of the city’s largest new developments, a 5.4 million–square–foot mixed-use project at 400 West 33rd Street.

Managing directors of the Carlyle Group

How could the Carlyle Group and its partners possibly top last year’s bonanza $300 million lease to Japanese retail clothier Uniqlo at 666 Fifth Avenue? Why, by enlisting Messrs. Stuckey, Chung (pictured) and Schoenfeld to do more of the same. As managing directors, the team has been behind some of the city’s biggest deals of the last few years, and few real estate observers believe that their pace will slow soon.

Chairman, president, CEO and tristate president, respectively, of Newmark Knight Frank

With Mr. Gosin as a lead broker, Newmark Knight Frank was the runner-up for the Real Estate Board of New York's 2011 "Most Ingenious Deal of the Year" award for the 247,433-square-foot deal for Local SEIU-32BJ. (Another Newmark broker took first place.) Such are the signs that the firm's influence, not only in leasing but in ownership, continues to increase under the ultimate helm of the likable lefty, Mr. Gural.

Vice chairmen at CB Richard Ellis

Ms. Stacom (right) is synonymous with big deals: the $5.4 billion sale of Stuyvesant Town and Peter Cooper Village in 2006; the sale of the former AIG headquarters at 70 Pine Street in 2009; and don’t forget the record-shattering $2.8 billion sale of the General Motors building in 2008. No slouch himself, Mr. Shanahan (left) has been ranked first among CBRE professionals worldwide for the past five years running.

Co-CEOs of LNR Property

Sprung from Wall Street, where both enjoyed fruitful careers, Messrs. Cobb (left) and Kennedy (right) joined LNR Property in October. Under the ownership of Vornado Realty Trust, the group has wasted no time in spearheading a number of investment goals, partly with a $200 million fund launched last year.

Capital Markets team at Jones Lang LaSalle

When Jones Lang LaSalle last spring poached this team from Cushman & Wakefield, the news clanged around the industry-how dare they? What lured the dapper quartet, to hear it from well-placed sources, was the firm's willingness to expand the group's investment sales and capital markets platforms. By all accounts, they've taken what was given to them by JLL and run with it.

President of the Real Estate Board of New York

The Real Estate Board of New York is among the most powerful trade groups in the country, if not the world. Its president since 1986, Mr. Spinola remains the go-to guy on industry issues, including, but not limited to, 421-a, rent regs, property taxes, J-51 and the 9/11 terror trials, which were supposed to take place downtown-until Mr. Spinola and his team pulled some strings in Washington. That's power, kids.

Chairman and executive vice president of Glenwood Management

Long before the recession turned condo developers across the city into rental mavens, Messrs. Litwin (pictured) and Jacob were focusing exclusively on the rental market. Now more than ever, the strategy has paid off, as even the most stable New Yorkers turn away from pricey condos in exchange for rentals they can more easily walk away from. So it's no surprise that, after buying land from Fordham for $125 million earlier this year, Glenwood is doing more of the same: a planned 54-story rental tower at 160 West 62nd Street near Lincoln Center.

President-CEO and chairman, respectively, of Prudential Douglas Elliman

The city’s biggest brokerage just keeps getting bigger, having added 822 brokers last year—during some of the darker days of the downturn, no less. A big part of their secret is chasing all those punch-drunk condos, helping to unwind the whole mess. The firm has also been ramping up its own eponymous Developments division. And as a side project, Mr. Lorber (pictured) has been quietly flipping tony townhouses that he bought on the cheap during said downturn.

CEO and president of the Corcoran Group

Corcoran may not have the cachet of some of its competition on this list, but they own much of the middle market, especially in Brooklyn, where Ms. Liebman led an aggressive charge in recent years. There have been some embarrassments over the past year, including a discrimination suit from an overweight ex-employee. Still, the firm’s chief has done much to cut costs and keep it afloat, despite takeover rumors.

Founder and director of daily operations, respectively, at Two Trees Management

Everybody knows about Dumbo, the land of pollutant-belching manufacturers that, relatively speaking, became a New York wonderland overnight. Now, with the buildings built and the space leased, what else are David (left) and son Jed (right) to do but hop over to Manhattan to re-create another swath of land in their own image. To be sure, the duo started construction on a 900-unit rental on 54th Street near 11th Avenue and inked a deal for a 340,000-square-foot office loft at 50 West 23rd.

Chairman and CEO of Forest City Ratner

With the last of the lawsuits behind him, Mr. Ratner began work on what may still be the most cutting-edge arena in the country, even without Frank Gehry designing it. The developer is struggling to find financing for the first apartment tower on the site-but if he does, there are rumors it could be the largest prefabricated structure in the world, and something with the possibility to transform the way New York builds. And there is a certain Manhattan apartment building he and Mr. Gehry managed to finish together.

CEO-chairman and president-CIO, respectively, of L&L Holding Company

When L&L Holding Company completed the $135 million renovations of 200 Fifth Avenue—formerly the International Toy Center—it was the most costly private endeavor of its kind in the city. That the very expensive repositioning happened in 2009 and 2010—at a time when few others were willing to spend that kind of coin—seemed to mirror Messrs. Levinson (right) and Lapidus’ (left) fearlessness in the face of an unsteady economy.

Commissioner of the Department of Transportation

Love her or hate her, no one has transformed more of the city over the past two years than the strong-willed transportation czarina. From Broadway to Water Street to Dumbo, Ms. Sadik-Khan has created simple sanctuaries with little more than asphalt, paint and some folding chairs. More plazas are on the way, as are fancy new bus lanes, from the East Side to 34th Street and into the heart of Brooklyn. But it is another set of exclusive lanes, ones involving bicycles, that have shown her true power as Mrs. Moses.

Chairman and President of the Durst Organization

The third-generation heads of this storied real estate family were at the LEEDing edge of pushing green buildings a decade ago, and now they may just lead us out of the recession. Durst/Fetner is working on a residential site on 31st Street and Sixth Avenue that may be one of the first major projects out of the ground post-Lehman. But it is their BIG pyramid at 57th Street and the Hudson that could ensure the new wave of brash buildings did not wash away with the recession. And need we mention drawing Conde Nast from their 4 Times Square to One World Trade? We need to: It could basically in time help upend the relationship between midtown (bride) and downtown (always the bridesmaid).

CEO and president, respectively, of SL Green

While its status as the city’s largest commercial landlord can be disputed (see No. 4), what can’t be argued is that under Messrs. Holliday and Mathias, SL Green has posted some of the most enviable numbers in New York in recent memory. To wit: As of last month, the REIT owned a financial stake in 61 properties across the city. As it and other REITs gobble up distressed hospitality assets as part of a cresting hotel boom, expect those numbers to continue rising.

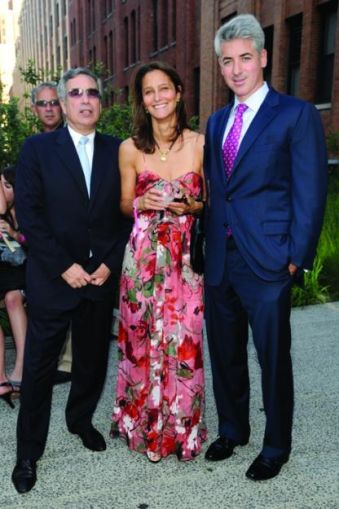

Chairman and president-CEO, respectively, of Vornado Realty Trust

Vornado has quietly become the most widely spread REIT in town, with a full or partial interest in 95 properties. Just within the past year, they (Fascitelli pictured) took a 25 percent stake in special servicer LNR Property Corporation, bought a $600 million stake in JCPenney and joined with SL Green to recapitalize 280 Park Avenue. Mr. Roth’s buddy Bill Ackman (No. 17) summarized it best: “Vornado,” he said, “is the only REIT that’s opportunistic.”

Chairman of Boston Properties

Boston Properties just needs one major tenant and it could break ground on 125 West 55th Street, the first office development since SJP’s 11 Times. Meanwhile, the landlord has brought No. 85 Harry Macklowe’s former 510 Madison back to life, with rents north of $100 per square foot and a possible lease by SAC Capital. The REIT owns or has a stake in 14 properties around the city, focusing on the high-end office properties that are coming out of the recession especially strong.

President of Extell Development

In July 2009, this newspaper dubbed Mr. Barnett “the busiest man in New York real estate.” We weren’t lyin’—though the Extell chief has taken it up a notch of late. The International Gem Tower on 47th Street started to go vertical this year, and workers are busy at a 70-story hotel-condo on 57th Street. Plus, Mr. Barnett has recently been buying properties like mad near the Gem Tower. More to come coming out of the recession? You will read it here first.

Mayor of New York

The Christmas blizzard, Cathie Black and a high real unemployment rate haven’t been good for a mayor suffering from third-term flu. But Mr. Bloomberg remains immensely influential for Big Real Estate, especially when it comes to incentivizing development and ensuring plenty of fresh spaces for it (read: rezonings). It doesn’t hurt that he’s the richest guy in town—this is New York, so that matters—and that he uses his office to advocate the sorts of pro-business policies that make the industry swoon.

Senior managing director and Real Estate Group co-head at Blackstone

Blackstone, the world’s largest private-equity group, walloped analysts’ expectations in the first quarter of this year and boasted its best three months since becoming a public company several years ago. The firm’s success was largely credited to its real estate investments, led by Mr. Gray. The boy wonder finally cracked 40 this year, and recently Blackstone announced that it is planning to raise its next real estate fund, with a target of about $10 billion, later this year

China’s president and general secretary of the Chinese Communist Party

Mr. Hu represents the Chinese investors who have beat a steady march to iconic New York properties recently. Li&Fung signed one of the largest leases since Lehman, nearly 500,000 square feet, at the Empire State Building. Vantone Industrial is the only private tenant to have closed a deal at the erstwhile Freedom Tower. A Chinese construction firm also purchased the landmarked American Bank Note Building. Chinese banks also quietly helped refinance local towers, in a sign the original other Red State is here to stay.

Chairman and CEO of Island Capital

Since liquidating nearly all of his co-investments with Dubai World following what can fairly be described as seven of the most development-crazy years ever recorded in the emirate, Mr. Farkas (right) has continued to invest across the world. When he isn’t building high-end marinas and five-star hotels, the babe magnet and real estate magnate is likely yachting or glad-handing the most powerful people in the world (including his former employee, Andrew Cuomo, No. 2).

President of Malkin Holdings

Following lengthy litigation against former investment partner Helmsley-Spear that resulted in the financial untangling of 10 Manhattan properties, Mr. Malkin led a mission to reposition each and every one, including the Empire State Building. The work now nearly completed on all of them, the company has seen dramatic leasing activity throughout its portfolio of buildings. Not too shabby for a supposedly great recession.

Managing directors of Fortress Investment Group

Since the middle of last year, the Fortress Investment Group has seen its profits rise after a long lull. And so the hedge fund has once again begun gobbling up both big companies and properties (such as The Sheffield, pictured) with abandon. Speaking of the latter, it has been thanks to the leadership of managing directors Constantine Dakolias and Chris Linkas that the company has regained its footing and investment savvy with regard to real estate.

CEO of the Trump Organization

On page 198 of his 2007 book, Think Big & Kick Ass in Business and Life, Mr. Trump advises, “Because I get screwed all the time, I go after people. You know what, people don’t want to mess with me as much as others. They know if they do they are really in for a big fight. Always get even.” The developer of such city sites as the Trump International and Trump Place is not to be trifled with—he remains the personification of New York real estate for the masses.

Co-CEOs of Tishman-Speyer

For the average New Yorker, “setbacks” include heavy traffic on the BQE, say, or rain delays at a Mets game. For the Speyers (Jerry pictured), a typical setback might include the $5.4 billion debacle of Stuy Town. Even as that big investment unraveled alongside the economy, it remained business as usual for the mega-landlords, who have continued to gobble up trophy assets all across the globe, including a $95 million asset in Paris and office towers in Washington, D.C.

Chairman and CEO of Starwood Capital Group

Even three years after the recession first sent shivers down the spines of real estate investors, money is still hard to find. But not for Mr. Sternlicht’s Starwood, which only a month ago deployed $352 million through three—three!—separate transactions. Among them, the origination of a $30 million mezz loan on an Upper East Side boutique hotel put the private firm on top of a hospitality boom that experts believe will continue, unimpeded, through the near future.

Founder and manager of Pershing Square Capital

He may be a hedge fund manager, but an upbringing in the bare-knuckle world of New York City real estate made Mr. Ackman (right) one of Wall Street’s shrewdest investors. From his failed takeover of Target (and subsequent success at JCPenny with No. 4 Steve Roth) to his jaw-dropping buy of bankrupt General Growth Properties, he looks at publicly traded companies as if they were property. Like Stuy Town, where he may not have won out but still broke even by making CW Capital buy him out.

Regional CEO of CB Richard Ellis and chairwoman of REBNY

Last year, Ms. Tighe was sworn in as the first female chair ever (and first broker in 30 years) of the Real Estate Board of New York, the 114-year-old group that secretly runs the city. For the industry, it was a major milestone, but hardly the first big achievement in Ms. Tighe’s prolific career. Her current clients include biggies like Condé Nast, the Times Company and the Catholic archdiocese of New York.

Chairman and CEO of RXR Realty

Formed shortly after the sale of Reckson Associates to SL Green in 2006, RXR and its chief executive, Mr. Rechler, sat on the sidelines throughout the darkest days of the economic collapse—in part because of a non-compete agreement with SL Green. Now back in action since 2009, the company has amassed some $4 billion in assets and about 11 million square feet of property. Most recently, the group bought into a partnership interest at 340 Madison Avenue and took 1330 Avenue of the Americas.

Chairman and CEO of the LeFrak Organization

If you’ve ever driven through Brooklyn, Queens or New Jersey, chances are you’ve come across one of the more than 70,000 mostly blue-collar apartments developed by the LeFrak Organization since its start in 1901. But under the blunt Mr. LeFrak, the company’s third-generation president, the group has swerved in a new direction, primarily toward upscale residential assets and loads of commercial office properties, which now represent 40 percent of its income.

CEO and chairman of iStar Financial

Look no further than the ticker to see that among mortgage REITs, iStar Financial is the leader of the pack. Last month, in fact, the group outperformed all competitors by posting a 77 percent gain in trading activity on April 17. Meanwhile, after months of shopping around $84 million in debt at the foreclosed-upon 47 East 34th Street, Mr. Sugarman, it appears, may have finally found a buyer in the investment firm CIM Group. If the troubled building changes hands, it will be another accomplishment.

Speaker of the New York State Assembly

If you’re reading this paper, chances are you’re a real estate industry professional. What’s also somewhat likely is that you pull in more than $300,000 a year. If that’s you, then Mr. Silver is your guy. In office since God was a boy, the speaker is calling for a controversial expansion of rent-regulation laws that would offer protection to some of the city’s wealthiest people. Love him or hate him, Mr. Silver will not be ignored.

Chairman and president, respectively, of Rubenstein Communications

Talk to a reporter, likely a member of the so-called liberal media, and most will say it isn’t the oil barons, gun lobbyists or Sarah Palin that truly ruffle their feathers but, rather, the spokespeople representing them and others. Be that as it may, these are the gatekeepers who keep their clients on top and the journalists at bay. For this father-son duo (Howard pictured), that strategy is routinely applied to many of the names on this list.

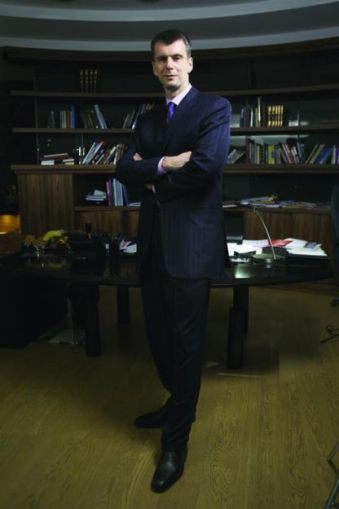

Controlling owner of the New Jersey Nets

When Mr. Prokhorov stepped forward last year as the new owner of the New Jersey Nets, he not only established himself as the latest real estate investor to interlope the city’s gridlock of property assets, but also forced himself onto Gotham’s cultural scene. So much so that New York magazine named him as the leader of the city’s “Global Russians.” Whether he can really make it in this town has yet to be seen, but, either way, for now he’s bought himself a ticket to the top.

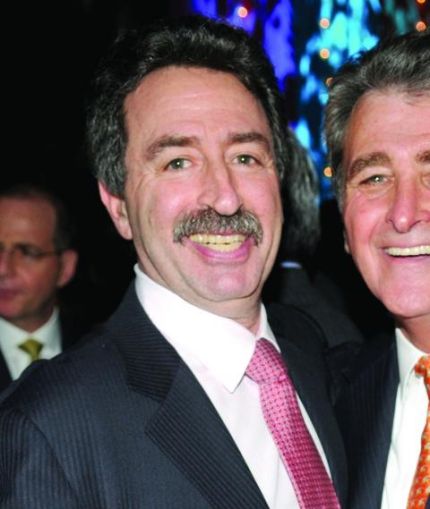

Chairman of real estate department and partner, respectively, at Fried Frank

Throw a rock during the Real Estate Board of New York’s annual gala and you’re sure to hit one of Mr. Mechanic’s (pictured) current or former clients. Hope it’s the latter because, while charming and personable, he and Mr. Lefkowitz won’t hesitate to chew you up on behalf of said clients, who include[d] Donald Trump (No. 14), Jerry Speyer (No. 15), Michael Bloomberg (No. 7), Steven Roth (No. 4), Stephen Ross (No. 10), Bruce Ratner (No. 48), Douglas Durst (No. 1), Mort Zuckerman (No. 5) and Sheldon Solow, to name a small fraction.

Landlord

The mysterious Mr. Schron is one of the city’s largest individual landlords—estimates peg his holdings at 15 million square feet, including tens of thousands of outer-borough apartments and stakes in such commercial properties as the Woolworth Building. He plays his work close to his chest, relying, it is said, on his several sons (there’s eight kids and at least 50 grandkids in total) and quietly investing in things beyond real estate, like banks and nursing-home chains.

President of Stribling & Associates and director of Stribling Private Brokerage, respectively

As if having charmingly stepped from some casting call for highbrow real estate brokers, the elegant Ms. Stribling (her real estate chops go back to 1967!) and the stately Mr. Henckels (pictured, bow ties and all!) embody in appearance and deed the luxury end of Manhattan housing. A cursory scan of Mr. Henckels’ latest listings, for instance, shows a $27.5 million ask at 810 Fifth and an “Estate in Umbria” for $17,418,440.

President of Halstead Property

Ms. Ramirez (right) co-founded Halstead in 1984; she inked her last multimillion-dollar real estate deal as a broker for none other than Calvin Klein, three years later; now the firm’s president, she spends much of her time reshaping the firm in her own classy image. Last year, she personally appealed to then free agent LeBron James to sign with the Knicks and move to New York while also working behind the scenes to sell Senator Kirsten Gillibrand’s Hudson Valley home.

Chairman of the Landmarks Preservation Commission

Since taking over the Landmarks Preservation Commission eight years ago, Mr. Tierney has overseen one of the largest expansions of protections for the city’s historic fabric, with a particular focus on the outer boroughs. Perhaps he has been too successful, as a massive district along West End Avenue—among others—is taking fire from Big Real Estate for stifling development. Recessionary knee-jerk or a coming backlash?

Principals of Terra Holdings and Zeckendorf Realty

Under the brothers’ (Arthur pictured) leadership, the family’s real estate legacy has since expanded to include the ownership stakes in brokerages like Brown Harris Stevens and Halstead. Meanwhile, they have scooped up some of the city’s most regal real estate, and maybe the world’s. Indeed, 515 Park has hosted producer L.A. Reid, and 15 Central Park lays claim to former Citigroup chair Sandy Weill, Goldman Sachs chief executive Lloyd Blankfein and Denzel Washington.

Managing director at Prudential Douglas Elliman

A raging bull with the intense quietude of his father, Raphael De Niro has gone from famous kid to famous broker in just a few short years. This year, he led the top-selling team at Douglas Elliman, after a sixth-place showing the year before. His client list reads like an invite to a party at his Soho loft: Naomi Campbell, Mark Ronson, Pink and Mickey Rourke.

Commissioner of Housing Preservation and Development, and president of New York City's Housing Development Corporation, respectively

In March, Mayor Bloomberg took a vacation from appointing outsiders by naming Mr. Wambua (pictured) as the city’s latest housing commissioner. As a senior policy adviser back in 2002, he led bids for affordable housing in upper Manhattan and the South Bronx. Along with Mr. Jahr, the entrenched pair of do-gooders likely ruffle some feathers within the industry. So be it.

President and senior vice president, respectively, of Brown Harris Stevens

With the market, and particularly the market for townhouses, heating up again, the doyenne of uptown living is the broker to beat. Ms. Del Nunzio (pictured) still holds the all-time single residential record for the $53 million Harkness Mansion, and she had the biggest sale last year when the Duke-Semans manse went from Tamir Sapir to Carlos Slim for $44 million. Meanwhile, the redoubtable Mr. Willkie manages the many personalities under the BHS umbrella, including 350-plus brokers doing $3.4 billion in sales annually.

President and chairman, respectively, of Murray Hill Properties

In the early ’00s, Murray Hill really blasted off by originating a handful of high-net-worth funds. Since then, Messrs. Sturner (pictured) and Siderow, the firm’s founders, have raised more than $300 million in individual funds and, subsequently, escalated their little something into a major player. In the meantime, they did yeoman’s work last year to keep Pepsi from moving its bottling division in Westchester to Connecticut. The intense negotiations over three years netted the largest transaction in the county’s history.

Founder and chairman emeritus of Macklowe Properties

F. Scott Fitzgerald’s immortal words, “There are no second acts in American lives,” couldn’t have anticipated Mr. Macklowe. After a buying binge that would have made some of Fitzgerald’s protagonists envious, the developer saw his fortunes crumble in dramatic fashion. But as recently as last month, cranes appeared at the rubble-strewn site of the former Drake Hotel—an asset he won, then lost, and, in a joint venture with CIM, seems to have wrestled back into his fold.

Chairman-CEO and president, respectively, of Jack Resnick & Sons

Less than two years ago, Burton and Jonathan—the latter, the last of three sons to remain at Resnick & Sons—spearheaded the acquisition of 250 Hudson Street, a former printing building that they converted into office space for the wave of creative types moving to the area. The deal was a good investment for the family firm, which opened in 1928. But they’ve been relatively quiet, and, thus, there’s no way to tell what’s next for one of New York’s more dependable real estate names.

Former CEOs of Cushman & Wakefield

When Mr. Mosler (pictured) stepped down as chief executive of Cushman & Wakefield last year, it wasn’t entirely clear what his plans were, other than returning to brokerage. And so when it was announced this January that he would be teaming with another former Cushman chief executive, Mr. Mirante, to form a new brokerage services group, the news was akin to Bob Dylan, Tom Petty, George Harrison and Roy Orbison coming together as the Traveling Wilburys. The pair has been rocking big leases ever since.

Roman Catholic Archbishop of New York

Columbia and N.Y.U., as this newspaper noted earlier this year, may be gaining on the Catholic Church as New York’s biggest private landlord, but Mr. Dolan still oversees as sole proprietor vast and valuable properties in Manhattan, the Bronx and Staten Island. St. Patrick’s Cathedral alone has more than $191 million in assets, not to mention a prime Fifth Avenue location (God forgive us for being so cynical).

CEO of New York Tristate for Colliers International

He’s among the most outspoken real estate leaders locally—but God love him. Since the merger with FirstService last year, Mr. Jaccom has led all New York firms in a hiring splurge so big that if it had happened in a small town the financial push would have single-handedly revived the community’s economy. And while Mr. Jaccom tends to speak in superlatives, the heft of his rhetoric has yet to overshadow the recent activity of his brokers.

Founder and CEO of Winick Realty Group

With Duane Reade hell-bent on opening a new store on every corner of the city, its brokerage of choice, Winick Realty Group, could have chosen to hit the snooze button a thousand times and still wake up in a pile of cash. But never one to rest on laurels, Mr. Winick has aggressively expanded the firm’s leasing capabilities to include retailers both big and small.

President and CEO of Meridian Capital Group

Capitalizing on the economic recovery is something of a specialty for the boys and girls over at Meridian Capital Group. Just visit its busy communications department, which tirelessly churns out news of new financial deals several times a week. Here’s an absolute fact: From the Upper East Side to Lower Manhattan, Mr. Herzka’s powerful financing muscle flexes for miles.

President of the Rent Stabilization Association

Forget about the gun, cigarette and alcohol lobbies. It’s Mr. Strasburg and his confusingly named Rent Stabilization Association that should draw your attention—and sometimes does, like when the RSA president in March warned landlord advocates that Governor Cuomo (No. 2) “will crush you like his father did.” (The governor didn’t care for that: “I can’t believe they mentioned my family,” he thundered privately.) With legislation coursing through Albany that would extend rent regs set to expire in June, Mr. Strasburg remains a key player in an only–in–New York fight.

President of SEIU 32BJ

Mr. Fishman’s on a roll. In the fall of 2009, he backed the successful candidates for mayor, public advocate and city comptroller; and a year later he was at No. 2 Andrew Cuomo’s back (as well as the winning AG and state comptroller candidates’), securing more powerful ears for his powerful union. He is perhaps the first labor leader in the Rolodexes of every big landlord on this list.

CEO of Cohen Brothers Realty

If he wasn’t so damn talented, Mr. Cohen might be perceived as an egomaniacal real estate tycoon of the worst kind: prone to silly whims and, even worse, terrible investments. But when his interest in design inspired him to develop hubs across the country for designers, it worked. And, more recently, when he followed his muse to Hollywood, the movie he produced earned Oscar nominations. While still a full-time real estate pro, he’s now juggling multiple film projects. Good show!

Chairman of ABS Partners Real Estate

With eyes on Chinatown, Tribeca and, really, most of New York, Mr. Altman and ABS Partners Real Estate has been on a leasing binge. Besides a recent push to sell or net-lease 250 Canal, the group worked behind the scenes to revamp 185 Franklin, a small office building that under ABS leased three big spaces just last month.

Chairman of the New York office of Greenberg Traurig

With astonishing regularity—for a lawyer, at least—Mr. Ivanhoe has played a huge role in shaping the city’s skyline. As No. 31 Larry Silverstein’s lawyer, he helped erect the luxury Silver Towers on West 42nd Street and oversaw the purchase of the Plaza Hotel for El-Ad Properties. More than perhaps anyone else in this city with a JD, Mr. Ivanhoe has acted as an unofficial urban developer for years.

Senior vice president at Sotheby's

Is Ms. Boardman the biggest residential broker in the city? Nobody knows because she is certainly its most discreet, but that is where The Wall Street Journal pegged her a few years ago. The socialite-turned-broker has handled some hefty listings, including many of brother-in-law Aby Rosen’s mansions and the infamous Madoff home. Other boldface clients include Eli Broad, Jimmy Fallon and a handful of Rockefellers.

Founder and Publisher of the Curbed Network

Not only does Mr. Steele have the list’s best name, but his is the first name in street-smart blogging. There is the ever-so-snarky Curbed—which has launched editions in Chicago, Washington, Miami, Seattle and a glossy national site—as well as the premier restaurant and retail blogs in these cities. He has helped define the look, feel and sound of a million hyper-local blogs chronicling the minutiae of the city. And just look at his shirts.

CEO and president of Miller Samuel

Mr. Miller authors perhaps the most closely watched housing reports in the U.S. (sorry, Dr. Shiller): the Douglas Elliman quarterly snapshots. Long decisive for Manhattan condos and co-ops, they now include surrounding areas and the rental markets. Plus, Mr. Miller remains refreshingly free of spin. In January, he said of Manhattan housing: “Best case, we move sideways, but I’m more inclined to think we’re seeing a price or sales erosion in 2011.” Which is exactly what the stats have been showing.

CEO and president of Cushman & Wakefield

Since taking the reins of Cushman & Wakefield in March 2010, Mr. Rufrano has taken pains to visit many of the 230 offices the firm operates across 60 countries. What’s more impressive is his ability to stave off widespread rumors that he was brought in to boost the business for an eventual sale. “The reason I was brought in—and what my tour is—is to maximize the value of Cushman & Wakefield,” he told The Times. Either way, the proven executive will continue to have his hands full.

Chairman of Condé Nast

Condé Nast, the parent company of magazines like Vogue and Vanity Fair, demonstrated it had affordable yet decidedly fashion-forward taste in office space in the '90s, moving from Madison Avenue to the Durst Organization's then-new 4 Times Square and helping kick off a boom in property values. Hopes are high that Condé will likewise boost the downtown office sector, now that it's submitted a letter of intent to take 1 million square feet at another Durst work: 1 World Trade Center.

Majority leader of the New York State Senate

The Long Island Republican, more than any other elected official at the state level, is taking a stand against the extension of rent-regulation laws-and that's a power move that, it's safe to say, most in the real estate industry are rooting for.

Managing director at Cerberus Real Estate Capital Management

As one of the largest private-equity investment firms in the U.S., when Cerberus sneezes markets move. So it’s on Mr. Kravit, who specializes in real estate private equity, to make sure that the trains run on time. The former Blackacre Capital head has overseen high-profile acquisitions of the discount chain Mervyns and grocery store Albertsons while also overseeing the financing for a number of commercial and residential projects across the country.

Co-CEOs at Taconic Investment Partners

Going into the recession, Taconic Investment Partners had an ace in the hole in that they had just made a $300 million profit on 450 Park, which they sold at the market's peak for $500 million. And while Mr. Pariser admitted to The Observer in 2009 that times were indeed tough, he and Mr. Bendit bounced back with the titanic sale of 111 Eighth to none other than Google.

Principals of Crown Acquisitions

With the purchase early last year of the St. Regis retail condominium, the Cheras (Stanley pictured) catapulted to the more regal ranks of the real estate lions. With 24,700 square feet of space, leased to no less shabby a retailer than De Beers Diamond Jewelers, among others, the deal commanded a whopping $117 million.

Chairman of the Metropolitan Transit Authority

The looming sale of its midtown headquarters and two Madison Avenue buildings. The relinquishment of development rights over the West Side Yards. And the give-away of air rights at the Brooklyn rail yards. Indeed, sometimes it’s easy to forget that the M.T.A.’s job is to make the trains and buses run on time sometimes. But under Mr. Walder, the first transit pro to hold the job, New York’s corpuscular labyrinth of tracks has played second fiddle only to the agency’s real estate dealings.

President, executive vice president and vice president of government affairs, respectively, of New York University

Like Columbia University, its equally capable collegiate counterpart, N.Y.U. has been on an expansion tear. To read the blogs and listen to preservationists, the push to develop 2 million square feet of new classroom space, dormitories and offices is a death knell for Greenwich Village. But under this trio (Sexton pictured), the school is doing what it believes needs to be done to compete in academia.

President of Wharton Properties

It’s easy to imagine that Mr. Sutton walks the streets with his head down, eyes focused on the ground floor. Again and again, he succeeds in his real estate investments by repositioning retail properties from the ground up—namely through his keen sense of sidewalk-facing retail pursuits. He brought American Girl to 609 Fifth and Abercrombie & Fitch to 720 Fifth, and was heavily involved in the Aeropostale deal at 1515 Broadway.

Tristate president and CEO, tristate chairman and global brokerage chairman, respectively, of CB Richard Ellis

Under Messrs. Rudin (pictured), Alexander and Siegel (and Ms. Tighe, No. 18), the city’s largest commercial real estate brokerage has tallied endless best-of-the-year accolades, curated many of the biggest deals of the past few years and, generally, stayed afloat in the recession, only seeming to grow in size and influence. Their clients span this list.

President of Jones Lange LaSalle

Jones Lang Lasalle has earned its reputation as one of the industry’s most aggressive brokerages, scoring a high-profile investment-sales team from Cushman & Wakefield led by Mitchell Konsker, along with new leasing assignments, such as 625 Sixth Avenue. The firm is charged with leasing Goldman Sachs’ former hub at 85 Broad Street, too, currently the emptiest building in the city.

CEO and senior managing director, respectively, of HFF

Debt placement, investment sales, structured finance and distressed assets are all specialties that HFF, the capital markets and commercial real estate servicer, has used to its advantage during the tumultuous throes of the Great Recession. Under Messrs. Pelusi (pictured, left) and Tepedino, the group has taken advantage of markets from here to Dallas, closing, on average, two deals daily, each valued at $1 million or more.

CEO and chairman, respectively, of Massey Knakal Realty Services

One holds a black belt in tae kwon do and the other has great hair. But beneath the surface stuff, Messrs. Massey (pictured) and Knakal over the past 22 years elevated their concern into literally New York’s busiest investment sales brokerage. This year, coming out of the recession, they have begun to expand big time, launching a retail-leasing division under Benjamin Fox and a capital-markets group under Garrett Thelander. What does Rahm Emanuel always say? Never let a crisis go to waste.

Real estate columnist and an editor for the New York Post

Last November, Mr. Cuozzo bellowed from the tab’s pages that “the culture of self-congratulation in the retail-leasing industry is so entrenched, it’s almost impossible to get an acknowledgement of how dysfunctional our retail climate can seem to even casual observers.” It was trademark Steve—equal parts Andy Rooney and Howard Beal—making him not only a scoop machine, but the seminal bullshit detector in the industry.

Principals of Eastern Consolidated

Long before Lehman Brothers collapsed and economic instability reigned, this handsome husband and beautiful wife (Paris pictured) were exploring ways to expand Eastern Consolidated's loan sales platform. And while the endeavor took longer than expected to get off the ground, the group is now among the city's leaders with regard to navigating the era's new value metrics. Meanwhile, Eastern continues to aggressively pursue debt procurements in all corners of the city-Brooklyn, Queens and the Bronx included-as well as to broker investment sales like mad.

President-CEO of George Comfort & Sons

Ask anybody in the real estate game, and they’ll tell you that George Comfort & Sons held a pretty low profile. That is, before July 2009, when the group snapped up the last of No. 85 Harry Macklowe’s distressed commercial buildings, including the 1.8 million–square–foot Worldwide Plaza. At $590 million, the purchase was at the time the biggest to hit the city post-Lehman. And, just like that, the visionary Mr. Duncan had put the firm on the map. Two years later, he’s still making strategic plays.

Principals of Milstein Properties

The completion of two Battery Park City condominium towers a couple of years back marked a revival of sorts for Milstein Properties, which, due in part to a series of family legal disputes, had been largely inactive during the building boom that inspired so many of their competitors. But even as the third-generation scions remain somewhat quiet, the company’s 20 million square feet, including 50,000 apartments and 8,000 hotel rooms, continue to line the brothers’ (Howard pictured) pockets.

Chair of the Planning Commission and director of City Planning

While her power has waned since construction came to a near halt during the downturn, the socialite–turned–public servant still may be the most respected—some might say loathed—person in all of local real estate. With the power to bend developers to her wishes, Ms. Burden is responsible for many buildings on this list (Durst’s BIG Project, Extell’s Riverside Center) looking as daring as they do.

Principals of RFR Holding

He has been harassed by Orthodox Jews over his development interests in Israel, has sparred with Tom Wolfe in the pages of The Times and last year split with longtime-sometime business partner Ian Schrager. But Mr. Rosen (pictured)—the tragically hip, art-collecting owner, along with Mr. Fuchs, of such trophies as the Seagram Building and Lever House—manages to hang on. With the purchase of 530 Park last year, he and Mr. Fuchs hope to turn the rental building into high-end condos. The sun has yet to set for the city’s most flamboyant investor.

Chairman of Granite Broadway Development

After the Time Warner Center’s Mandarin Oriental, the soon-to-be Marriott Central Park (pictured) has bragging rights as New York’s tallest hotel. “But since that’s a big ol’ mixed-use project, with apartments, offices and even a mall,” wrote our own Matt Chaban of the Mandarin back in January, “that doesn’t count.” The hotelier behind the 716-foot-tall hotel on 54th Street is Mr. Gross, a guy who registers almost no Google or Nexis hits, rendering him all but invisible. But we do expect his Web traffic to spike.

Executive director of the Port Authority of New York and New Jersey

With the portentous 10th anniversary of 9/11 fast approaching, credit goes almost entirely to one of the smartest bureaucrats in the city (sorry, Larry!). Mr. Ward set new schedules for completing the memorial plaza in time for the hallowed day, and the four office buildings on the site are progressing in their own fitful ways. This would be job enough, but Mr. Ward is also undertaking modernization efforts at the region’s airports, container terminals, bus depots and bridges.

Principals of Fisher Brothers

If ever a real estate company could be counted as members of the mile-high club, the Fishers (Winston pictured) would be the group’s Class A ambassadors. With skyscrapers like 605 Third, 299 Park and 1345 A of A all boasting upward of 1 million square feet each, the 96-year-old company has a thing for heights. But with the sale last year of its minority stake in 229 Park, a.k.a. Park Avenue Plaza, the group sent a signal that size doesn’t always matter.

Principals of Square Mile Capital

After beating up Kent Swig and taking a bunch of his stuff in 2008, Square Mile Capital, the lender that was launched only two years earlier, gained some power. But not without earning a bittersweet rep as the company above all others willing to show fangs to delinquent borrowers. Since teaming with Taconic Investment Partners in the ill-fated purchase of 29 of the 32 commercial condo units at the universally loathed Verizon building, Messrs. Solomon (left) and Citrin (right) have shuffled their feet to sandboxes outside of New York.

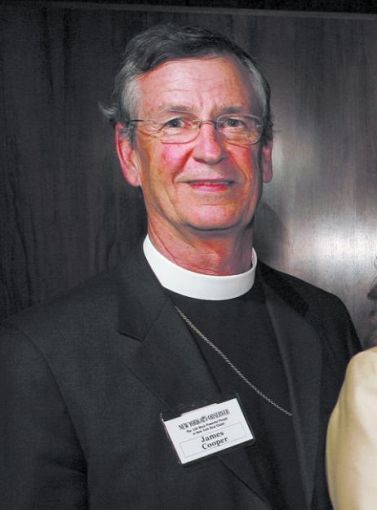

Rector of Trinity Church

Along with Trinity Real Estate president Jason Pizer, Mr. Cooper has continued to reposition the Episcopal church’s 6 million square feet in Hudson Square into appealing office space for creative tenants. As recently as 10 years ago, the vacancy rate for the area might have hovered around 20 percent. But with the likes of New York magazine, Penguin Putnam, Getty Images and WNYC there, Mr. Cooper’s property tabernacle now appears especially secure.

CEO of Union Square Hospitality Group

Mr. Meyer might be the most influential restaurateur in the city—and not because of the food he cooks, phenomenal as it may be. It is the way that everywhere he goes, he transforms neighborhoods. Union Square in the ’90s, Madison Square in the ’00s; and now he has set his sights all over town and beyond, as his Shake Shack empire expands into Connecticut, Battery Park City and Brooklyn’s Fulton Mall. He just opened Untitled inside the Whitney, bringing barnyard hominess to the starched hood.