Places, Everyone! The New Development Boom Is About to Start

By Laura Kusisto April 20, 2011 3:17 pm

reprints Thick black slabs of plywood encase what some call North America’s most valuable development site. The location of the onetime Drake Hotel, now a rubble-strewn yard at Park Avenue and 56th Street, is literally a black box.

Thick black slabs of plywood encase what some call North America’s most valuable development site. The location of the onetime Drake Hotel, now a rubble-strewn yard at Park Avenue and 56th Street, is literally a black box.

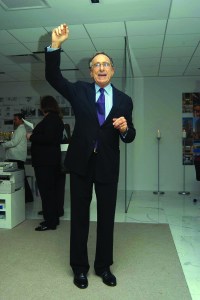

A black box to everyone, that is, except Harry Macklowe. Barely two years after his fortune was nearly wiped out by an ill-fated $7 billion, seven-skyscraper spree, the litigious genius-just into his eighth decade, with long jowls and a beakish nose-is the surprising developer behind ambitious plans for a possible 70-story condo tower with three stories of luxury retail.

“Harry is a force of nature,” said Woody Heller, a top broker with Studley. “He is a man in perpetual motion. He has one of the most creative minds I have ever known.”

The golden shadow behind Mr. Macklowe is CIM Group, the Los Angeles-based owner of thousands of apartments nationwide, who bought the distressed site in early 2010 from Deutsche Bank in a $305 million all-cash buy.

“It is one of the most brilliant deals,” said Mr. Heller, the sole broker on the sale, “that CIM or Macklowe will have done.”

Both partners—who, according to a source with knowledge of the negotiations, have a money partner-developer relationship—disdain media attention and have said nothing about their plans. But, recently, an orange crane appeared in the northwest corner and workers began dismantling an adjoining townhouse on 57th Street. In March, CIM secured a modest $30 million loan, and on Friday The Observer reported that the developers had filed preliminary plans with the Department of Buildings.

That is to say: The stage is set, the characters are in place and the curtain is about to rise on the first act of a new development boom in New York City. And perhaps the biggest plot twist of all: Harry Macklowe is once again a star.

IN 2006, HARRY Macklowe had just completed a peculiar glass cube in front of his GM Building on Fifth Avenue. It would become Apple’s new cathedral to high-tech consumerism and one of the world’s most profitable retail locations. Banks were willing to lend him money for almost anything he wanted.

What he really wanted, though, was the Drake, a faded Gilded Age hotel set at the inflection point of the city’s best retail, office and residential areas. In early 2007, he dropped $418 million and amassed $543 million in loans on buying the site, at 440 Park Avenue. Despite the staggering economics, the deal went smoothly.

“I think that he wanted that very badly and it was a time when financing was not a problem,” said one person. “Deutsche Bank was pretty anxious to provide financing to him for anything he did.”

Mr. Macklowe originally envisioned a hotel-condo tower, angled at the corner of Park Avenue and 57th Street, sources say, with a Nordstrom’s. But like the luxury office tower he built at 510 Madison-whose gestational years as a Setai hotel explain the presence of a swimming pool-his vision for the Drake development has evolved.

He razed the former hotel to the ground, but before he could begin building, in November 2007, Macklowe Properties defaulted on the loan. Unlike many lenders this last recession, Deutsche Bank played hardball and sued its borrower in August 2008. Like a spurned lover, Mr. Macklowe responded in a legal brief that the lender “strung Macklowe Properties along until Deutsche Bank got what it wanted, then refused to honor its commitments-benefiting handsomely from its willfully dishonest, deceptive, bad faith and fraudulent conduct at Macklowe Properties’ expense.”

Mr. Macklowe’s subsequent decline would mesmerize an industry. He started his career as a broker in the ’60s and first amassed a fortune as a developer in the ’80s, also garnering a reputation as a bare-knuckled player. He gained particular notoriety in 1985, when his development team, under cover of darkness, illegally tore down two Times Square residential buildings to make way for a new hotel. His fortunes dipped during the recession of the early ’90s and he, along with his son Billy, built the company back up by 2003—most famously in 2007 by dropping $7 billion to buy seven skyscrapers from Blackstone, using only $50 million of their own money.

By February 2008, a $6.4 billion tab came due. Mr. Macklowe would lose almost everything-including the GM Building and his working relationship with son, who split with him in May 2008 and went on to form his own firm.

The elder Macklowe continued to search for a savior for the Drake site, but few developers in the city had cash to spend on a pricey development in that first bitterly cold winter of the recession. CIM appeared out of nowhere in January 2010 and struck a deal to buy the site that would keep Mr. Macklowe involved. It was the West Coast apartment owner’s first New York City buy.