The Op-Ed Page: Don’t Let This Crisis Go to Waste

By Tom Acitelli September 22, 2009 2:51 pm

reprints The financial crisis of the past year presents a unique opportunity to consider and actually undertake major changes that are not achievable in good economic times.

The financial crisis of the past year presents a unique opportunity to consider and actually undertake major changes that are not achievable in good economic times.

Rather than bemoaning the lack of demand in the commercial real estate market, we must seize this opportunity to take steps to create future demand and ensure the financial viability of our economy so that New York continues to grow and remain competitive in a global marketplace.

Beyond the necessary short-term impact on the construction and real estate industry of TARP and TALF and the lack of liquidity in the capital markets, we must begin to look at fundamental structural issues that will severely inhibit our long-term prospects for building in New York.

To do this, we must address the artificially high costs of building in this city; the irrational real estate tax-assessment system; and the desperate need to create and preserve affordable and workforce housing.

Today, we recognize that the cost structures developed over decades, which we were able to absorb in periods of boom, no longer work today. Construction costs are inflated beyond anyplace else, which makes New York grossly uncompetitive with the suburbs and neighboring states. Much of this comes from arbitrary and outdated work rules that simply impose costly burdens on projects, with no corresponding benefit.

Although we have made some progress in the past few months, significant changes in work rules that will truly impact the cost of building must be achieved by the industry and labor working together. At the same time, we must also fulfill the mayor’s pledge to make the city more business-friendly by streamlining and modernizing the city’s approvals processes. Delays caused by unnecessary red tape and inefficient processing and inspections impose excessive costs that can even make projects unfeasible.

Just take a look around the city to see the stalled projects that litter our skyline. We need to take bold steps to make these projects financially viable and prepare them to move forward again when liquidity returns to the market. This will enable us to unleash economic benefits for our city, including thousands of construction jobs for our workers, and increased tax revenues for our government to fund essential services.

The city has done a laudable job in the areas of public safety and public schools, but we must now address the arcane inequality in the real estate tax-assessment system, which unfairly burdens commercial buildings and multifamily rental properties. Each of these two asset classes, which are essential to our future economic health, pay higher taxes than other classes of buildings, a cost that is passed on to tenants and creates a class distinction between apartment renters and apartment owners. We cannot continue to have commercial properties and residential rental buildings shoulder an unfair burden of the tax load, undermining the city’s clear policies to grow the economy and stimulate new housing.

And we must ensure that we preserve and create affordable and workforce housing. In the past few years, speculative investors bought moderate-income housing and sought to convert it to market-rate. This has badly damaged the balance of our housing stock. We now need to create a new generation of housing finance tools at the federal, state and city levels to deal with today’s financial realities. What does this have to do with commercial real estate? A city without housing for its working class, the lifeblood of our economy, cannot grow, cannot prosper and cannot attract and maintain its commercial core.

We must preserve those irreplaceable units that are in danger of being converted to market-rent. We need a multipronged approach, including short-term-equity stop-gap measures for the current lack of low-income tax credits; programs that encourage investment in affordable housing; and reinstitution of incentive programs like the 421-a tax abatement.

And we must work with the federal government to expand the income limits in the tax-exempt bond program to actually accommodate the income levels of the city’s working middle class. While the current limits may work in other parts of the country, they simply do not work in New York City.

Though none of these issues are simple, we must use this period of pause to rethink and reset the structural foundation for building in New York if we are going to restart the private economy, build for a prosperous and competitive future and keep our city the greatest in the world.

editorial@observer.com

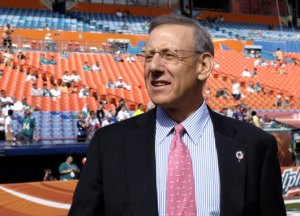

Stephen Ross is chairman and CEO of Related Companies, and chairman of the Real Estate Board of New York.